Kendrion this year in head group car services sector

Thanks to the huge profit of 53 percent since begin this year it's one of the best shares of the car services sector. The average stock of the car services sector yielded the this year a profit of 20 percent.

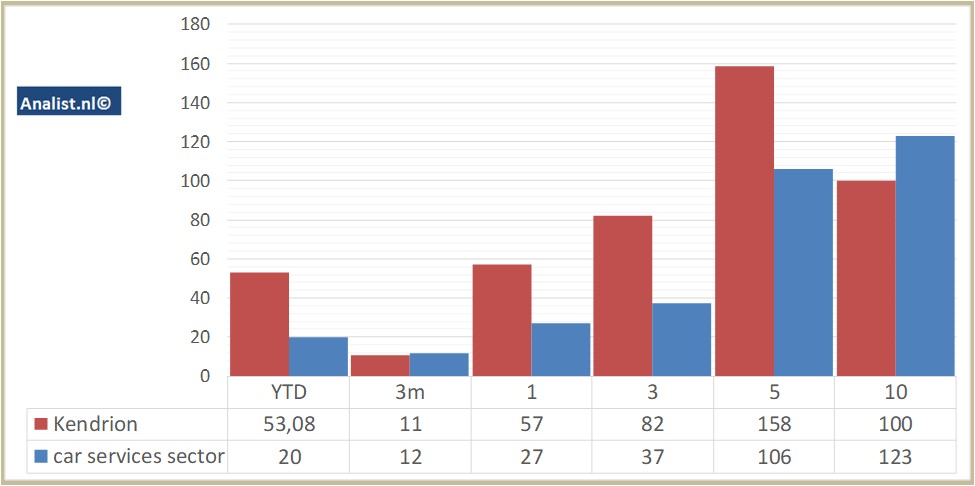

Returns Kendrion versus car services sector

Buy & hold Returns stock Kendrion over several periods, excluding dividend returns

Investors who invested in 2007 in the company's share now have a strong profit of 100 percent. Since 2012 the stock has a price gain of 158 percent. Over the past 3 years the share has gained as well.

The sector trades now at 45 times the earnings per share. Currently the sector trades at 2,1 times the book value per share. Since 2012 the sector has a profit of 106 percent and since 2007 a higher of 123 percent.

Based on the analysts' estimates both the revenue and the net result would be the highest in years. For this year Kendrion 's revenue will be around 463 million euros. This is according to the average of the analysts' estimates. The expected revenue would be the highest in her history. This is slightly more than 2016's revenue of 443,4 million euros.

Historical revenues and results Kendrion plus estimates 2017

The analysts anticipate for 2017 a record net profit a 25 million euros. The majority of the analysts expects for this year a profit per share of 1,92 euros. The PE-ratio therefore is 21,33.

Per share the analysts expect a dividend of 0,94 cent per share. The dividend yield is then 2,3 percent. The average dividend yield of the automobile companies is a moderate 0,78 percent.

Most recent target prices around 40 euros

The most recent recommendations for the automobile company are from NIBC, ING and Kepler Capital Markets. Based on the current number of shares Kendrion 's market capitalization equals 540,05 million euros.Historical stock prices Kendrion

At 10.51 the stock trades 0,79 percent lower at 40,95 euros.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.