Knorr-Bremse sees sales growth in EU, US and China

Huge order Hitachi Rail

Knorr-Bremse, a leader in braking systems for rail and commercial vehicles, recently reported robust financial performance, underscoring its expansion in several key markets. For the first nine months of 2023, the Rail Vehicle Systems (RVS) division achieved a nearly 12 percent; revenue increase compared to the prior year, bolstered by strong demand for its brake control systems, such as CubeControl, which is now being integrated into high-speed trains in Sweden under a new contract with Alstom . This division also secured a significant order from Hitachi Rail to supply braking systems for Milan's metro trains and expanded its presence in South Korea and China, which has helped maintain a record order book value of over €5 billion. However, its operating profit margin experienced a slight decrease due to pre-existing contracts not accounting for inflation.

More revenue commercial vehicles

In the Commercial Vehicle Systems ( CVS Caremark ) division, revenue increased by over 13 percent; due to high truck production in Europe, North America, and China. The division's profitability has benefited from successful pricing adjustments and cost management, pushing EBIT margins up to 10.6 percent; in the third quarter. Additionally, Knorr-Bremse is committed to its long-term sustainability targets and innovation through its eCUBATOR unit, focusing on zero-emission vehicle technology. They've also recently launched aftermarket services in South America, expanding their global footprint.EBIT 2026 above 14 percent;

Overall, Knorr-Bremse's recent BOOST 2026 program is guiding these initiatives, aiming for enhanced profitability and a sustained EBIT margin above 14 percent; by 2026. Their ongoing portfolio review and recent divestments, like the sale of their US Sheppard Foundry and Kiepe Electric, are intended to streamline operations further, aligning the company with its strategic efficiency and growth goals.

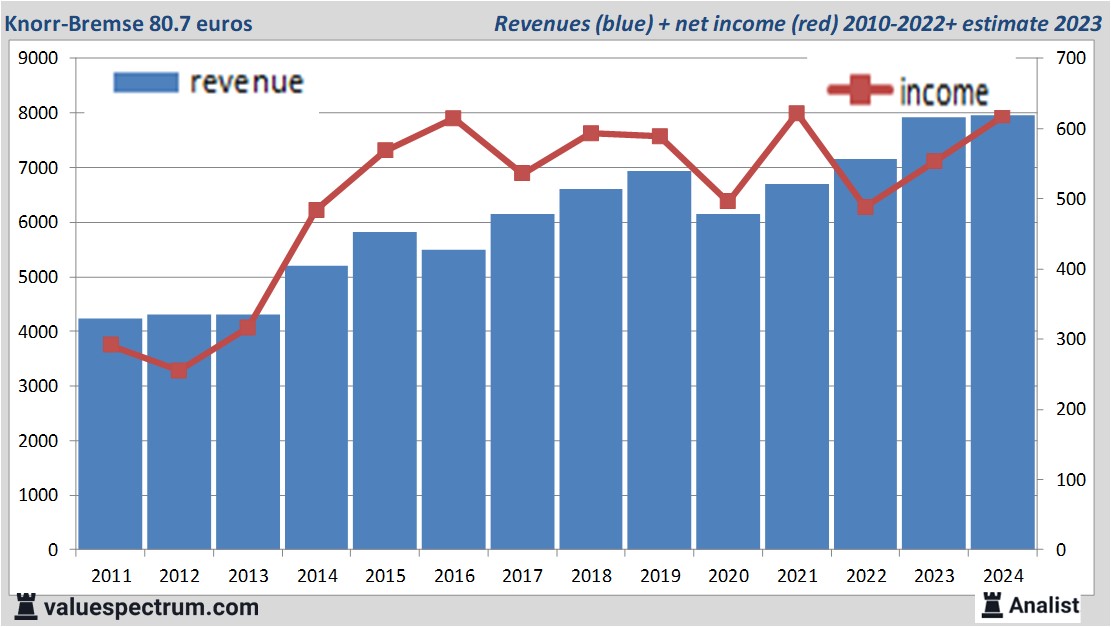

Tomorrow the German Knorr-Bremse will report its past quarters results. Over the current book year the total revenue from the company in Munchen will be 7.96 billion euros (consensus estimates). The expected revenue would be the highest in her history. This is slightly more than 2023's revenue of 7.93 billion euros.

Historical revenues and results Knorr-Bremse plus estimates 2023

The analysts expect for 2024 a net profit of 618 million euros. According to most of the analysts the company will have a profit per share for this book year of 3.83 euros. Based on this the price/earnings-ratio is 21.04.

For this year the analysts expect a dividend of 1.79 euros per share. Thus the dividend yield equals 2.22 percent. The average dividend yield of the automobile companies equals a relatively high 3.03 percent.

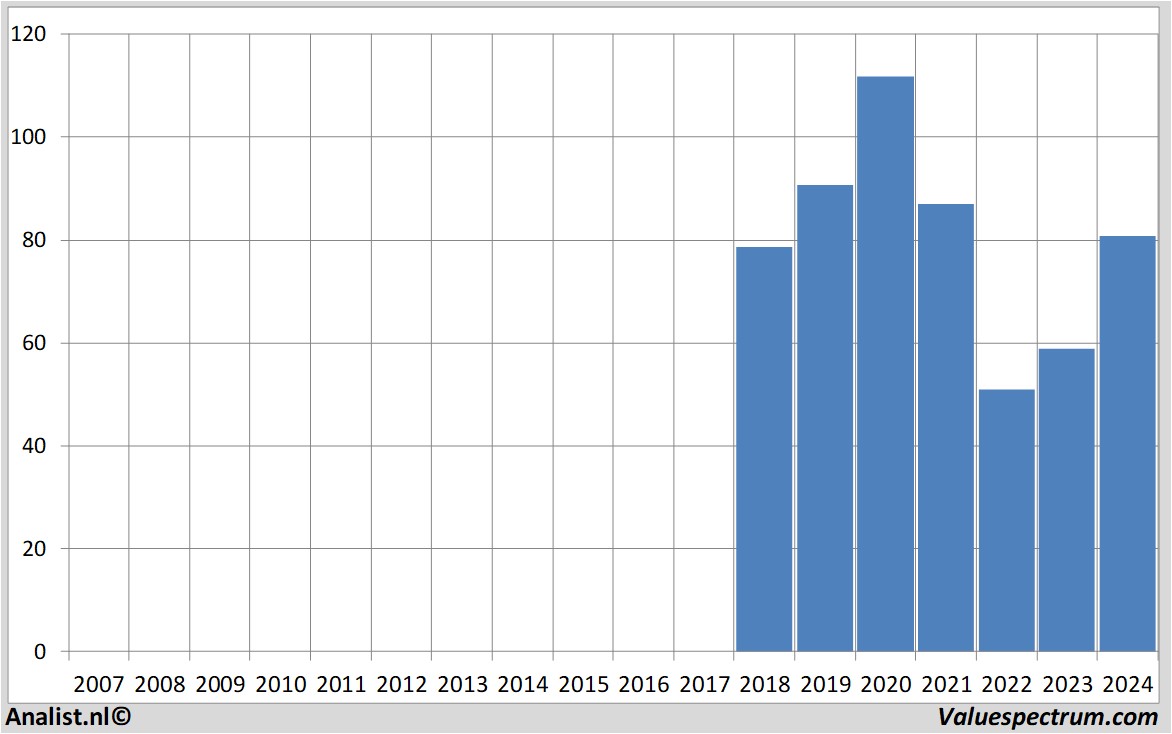

Latest estimates around 83 euros

The most recent recommendations for the automobile company are from Deutsche Bank , UBS and M.M. Warburg & Co..Knorr-Bremse's market capitalization is based on the number of outstanding shares around 12.99 billion euros.

Historical stock prices Knorr-Bremse

Analist.nl Nieuwsdienst: +31 084-0032-842

nieuws@analist.nl

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. Analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.