Why Are Investors Worried About Bank of America Corp (BAC)

Bank of America (NYSE:BAC) shares gained a lot of value earlier this year amid the election of President Trump. Investors had hoped that tax cuts, increased spending on infrastructure, and rate hikes will help Bank of America ’s finances. But the new administration didn’t implement its promised polices. As a result, Bank of America stock is losing as the optimism is waning.

In the third quarter, BofA’s interest yield came in at just 2.36%, which shows that the company’s total return on loans is declining. Analysts also think that Bank of America will lose value in the future as the Federal Reserve has no plans on long-term rate hikes. The upcoming chairman of the Federal Reserve is expected to continue the current policies. However, not all hope should be lost on Bank of America (NYSE:BAC). The company remains the second biggest bank in the country in terms of assets. Consumer banking revenue increased by 10% year over year.

However, it should be noted that lending at the bank increased by just 2.4%, which shows a decline of growth. Bank of America (NYSE:BAC) is attractively valued when compared to other bank stocks.

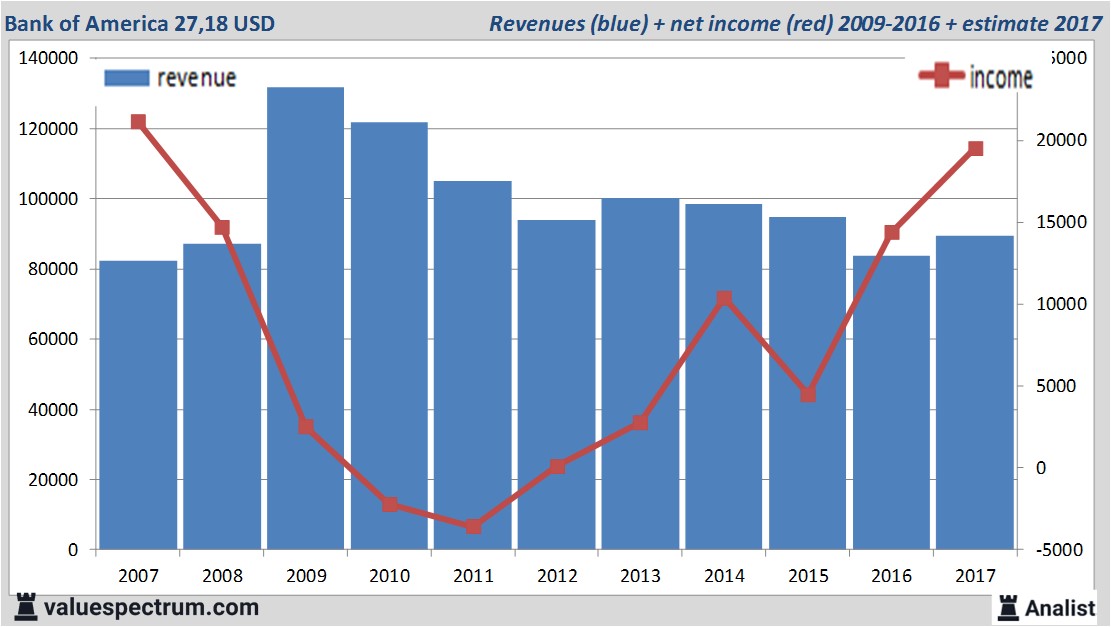

Over the current book year the total revenue will be 89,44 billion USD (consensus estimates). This is slightly more than 2016's revenue of 83,7 billion USD.

Historical revenues and results Bank of America plus estimates 2017

The analysts expect for 2017 a net profit of 19,51 billion USD. The majority of the analysts expects for this year a profit per share of 1,82 USD. So the price/earnings-ratio equals 15,25.

For this year the analysts expect a dividend of 0,39 cent per share. Bank of America 's dividend yield thus equals 1,41 percent. The average dividend yield of the banks equals a low 0,71 percent.

Most recent target prices around 30 USD

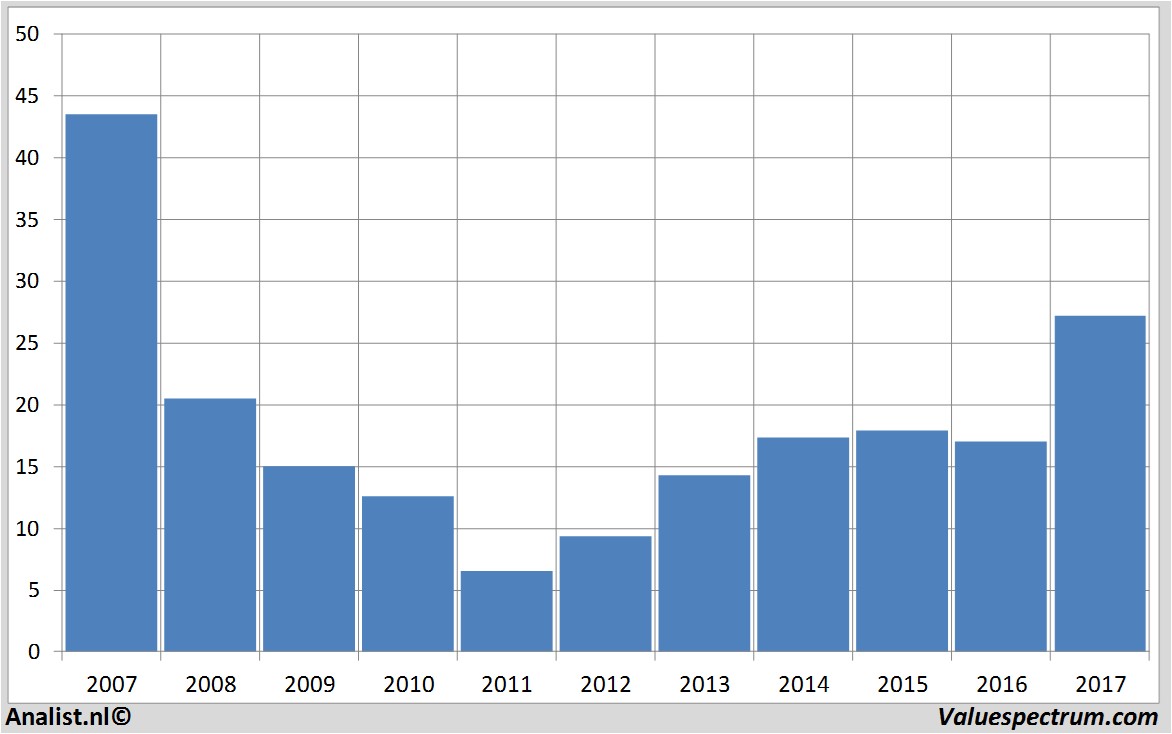

Sanford C. Bernstein & Co, Morgan Stanley and Credit Suisse recently provided recommendations for the stock. Bank of America 's market capitalization is around 288,05 billion USD. At 22.00 the stock trades 2,05 percent lower at 27,75 USD.Price data Bank of America 2007-2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.