ING Group finishes share buy back program

ING Groep has made notable recent moves and updates in its business activities. Just this month, ING completed a significant share buyback program, repurchasing almost 156 million shares valued at €2.5 billion. This program, initially announced in May 2024, saw consistent weekly repurchases, signaling ING's commitment to optimizing shareholder value. An update on the company's capital strategy and further plans is anticipated alongside the Q3 financial results release, scheduled for October 31, 2024.

In parallel, ING has been strengthening its sustainability and Environmental, Social, and Governance (ESG) initiatives, remaining a top contender in the sector, with high ratings from MSCI and Sustainalytics. ING has integrated these principles into its financing, actively promoting and supporting sustainable ventures while maintaining transparency about areas where further improvements are ongoing.

These developments underscore ING's focus on balancing capital returns with responsible, sustainable growth- a strategic alignment increasingly central to ING's operations and communications. For further updates, the company's newsroom provides regular insights and press releases on its global activities.

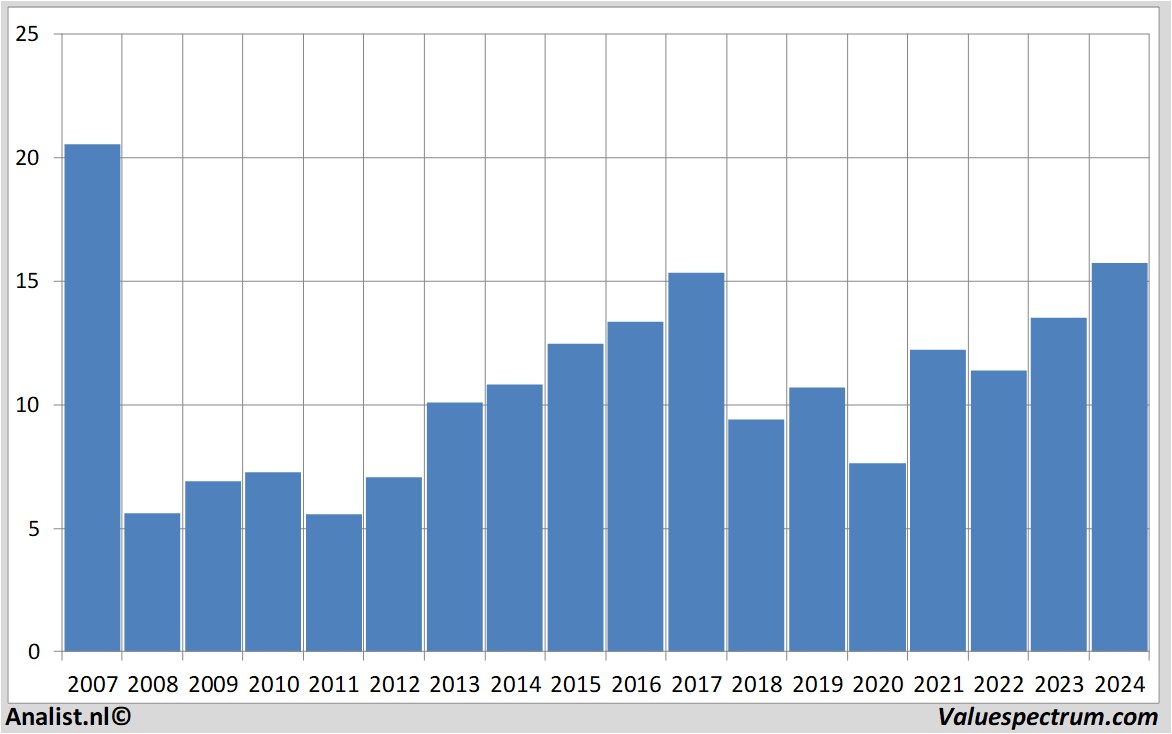

00Per share the analysts are expecting a dividend of 1 euros per share. The dividend yield is then 6.35 percent. The average dividend yield of the banks is an attractive 3.22 percent.Historical dividend returns ING Groep

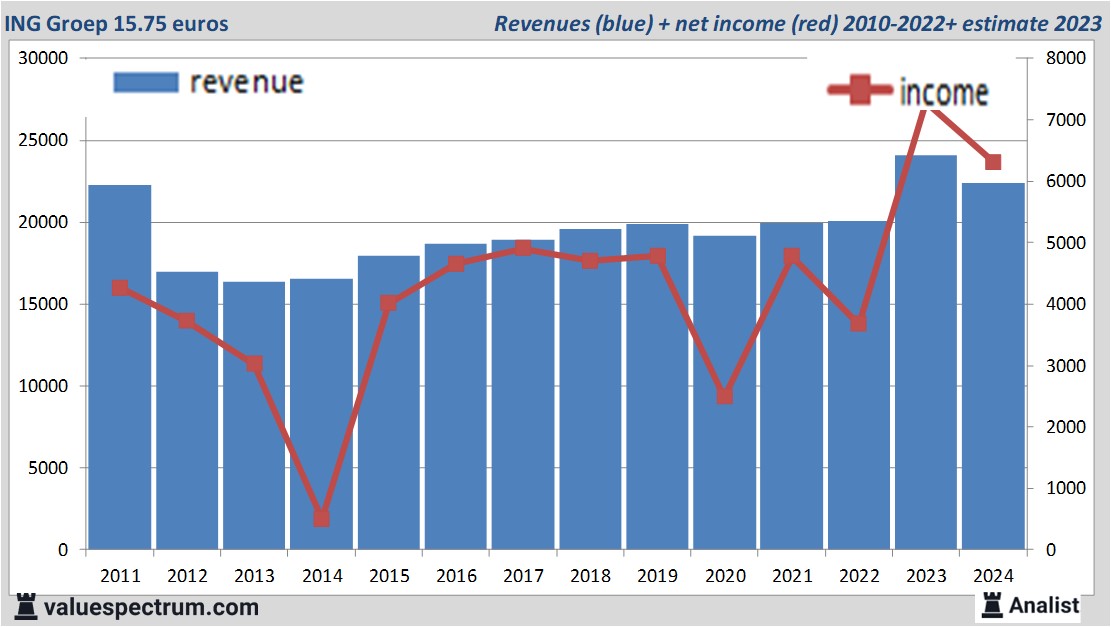

Tomorrow the Dutch ING Groep will report its past quarters results. For this year the company, based in Amsterdam revenue will be around 22.4 billion euros. This is according to the average of the analysts' estimates. This is slightly lower than 2023's revenue of 24.09 billion euros.

Historical revenues and results ING Groep plus estimates 2023

ING Groep Amsterdam ©  ING Groep |

The analysts expect for 2024 a net profit of 6.31 billion euros. The majority of the analysts expects for this year a profit per share of 1.98 euros. The PE-ratio therefore is 7.95.

Newest target prices around 20 euros

The most recent recommendations for the bank are from Berenberg, UBS and Oddo BHF.Based on the current number of outstanding shares ING Groep 's market capitalization is 56.99 billion euros.

Historical stock prices ING Groep period 2007-2024

On Tuesday the stock closed at 15.75 euros.

Analist.nl Nieuwsdienst: +31 084-0032-842

nieuws@analist.nl

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. Analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.