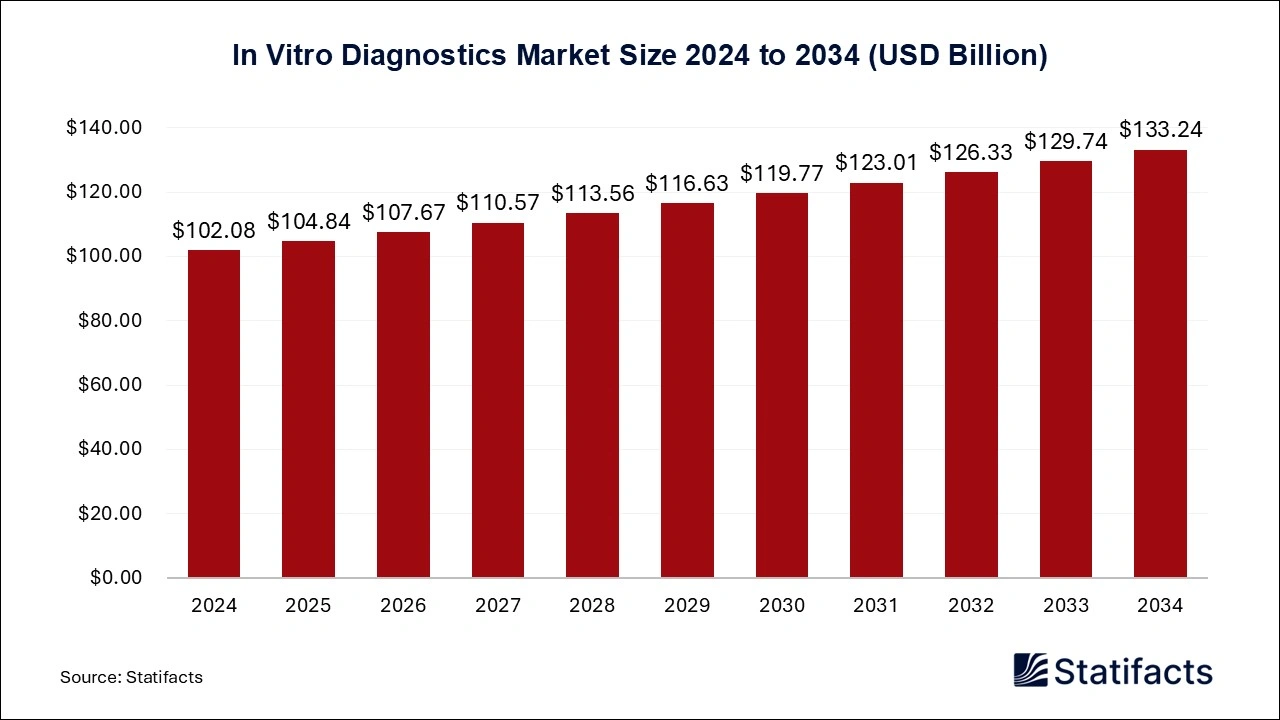

In vitro diagnostics Market Poised for Significant Growth to Reach value of USD 133.24 Billion from 2025 to 2034

According to Statifacts, the global in vitro diagnostics market size is calculated at 104.84 billion in 2025 and is projected to surpass USD 133.24 billion by 2034 with a remarkable CAGR of 2.7% from 2025 to 2034, North America In vitro diagnostics market dominated the global market and accounted for a 43.11% share in 2024.

Ottawa, Feb. 19, 2025 (GLOBE NEWSWIRE) -- The global in vitro diagnostics market size was valued at USD 102.08 billion in 2024 and is expected to hit around USD 133.24 billion by 2034 with a CAGR of 2.7% from 2025 to 2034,a study published by Statifacts a sister firm of Precedence Statistics.

The market is proliferating due to increasing cases of infectious and chronic diseases which led to adoption of automated IVD systems and their development by leading players, augmenting the markets growth globally on a large scale. the In vitro diagnostics market dals with the various tests developed by leading players to rapidly test and treat patients suffering from infectious and chronic diseases that can be fatal and increase mortality rate among population suffering from it, particularly people aged more than 65 are witnessing the symptoms of such diseases. According to the data revealed by UN economic and social affairs at the global level in the yar 2022, nearly 10% of people around the globe are aged more than 65.

This ratio is expected to witness people having age 65 and more will be 16% in 20250. Endocrine disorders majorly seem in the elderly population, highlighting the importance to develop systems like in vitro diagnostics to detect its accurately for further treatment. Major players are launching innovative test kits which are expected to fuel the market's growth further.

Moreover, in May 2024, bioMérieux announced that it received U.S. FDA 510(k) clearance for the VIDAS TBI (GFAP, UCH-L1), a serum-based test designed to assist in assessing patients with mild traumatic brain injury (mTBI), such as concussions. This innovative assay leverages a combination of two biomarkers, GFAP and UCH-L1, which are proteins that enter the bloodstream following cellular injury. The test offers a potential solution to reduce the number of unnecessary head CT scans for mTBI patients by predicting the absence of acute intracranial lesions (ICL). This advancement could significantly impact patient care by optimizing the use of imaging resources and reducing patient exposure to radiation.

Favorable initiatives undertaken by government and non-government bodies to improve overall healthcare services are anticipated to increase the market growth. In October 2023, the WHO published the Essential Diagnostics List (EDL), a comprehensive list of IVD products that helps countries make decisions regarding diagnostic tools. It provides evidence-based recommendations and ensures the accessibility of essential products for target people. Moreover, in August 2023, the Africa CDC collaborated with the Africa Development Agency-New Partnership for Africa's Development (AUDA-NEPAD) to increase access to diagnostic tests across Africa. Such initiatives are expected to increase the market uptake in developing regions.

Elevate your business strategy with market-driven insights—purchase the report today (Price USD1550) https://www.statifacts.com/order-report/7792

In Vitro Diagnostics (IVD) Market Key Takeaway

- North America Market has captured a revenue share of 43.11% in 2024.

- Asia Pacific in vitro diagnostics market is anticipated to exhibit significant growth at CAGR of 8.61% during the forecast period.

- By product, the Reagents held the largest revenue share of 68.19% in the market in 2024, the segment is expected to retain its dominance growing at the fastest CAGR during the forecast period.

- By technology, Immunoassay accounted for the largest revenue share of the market in 2024

- By application, the infectious diseases segment accounted highest revenue share of 54.61% in 2024.

- By end-uses, the laboratory segment has captured 39% revenue share in 2024.

- By test location, the point-of-care segment has held the largest market share in 2024.

In Vitro Diagnostics Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 104.84 billion |

| Revenue forecast in 2034 | USD 133.24 billion |

| Growth rate | CAGR of 2.7% from 2025 to 2034 |

| Actual data | 2018 - 2024 |

| Forecast period | 2025 - 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Products, technology, application, end-use, test location, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; UK; Germany; France; Spain; Italy; Russia; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Singapore; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

| Key companies profiled | Abbott ; bioMérieux SA; QuidelOrtho Corporation; Siemens Healthineers AG; Bio-Rad Laboratories , Inc.; Qiagen ; Sysmex Corporation; Charles River Laboratories; Quest Diagnostics Incorporated; Agilent Technologies , Inc.; Danaher Corporation; BD; F. Hoffmann-La Roche Ltd. |

Buy this Databook (Price USD1550) https://www.statifacts.com/order-report/7792

In Vitro Diagnostics Market Major Trends

Introduction of highly advanced kits ; The major trend in the global IVD market includes the launch of highly advanced kits by major players in the market. For instance, in Jan 2024, CE-IVDR-certified GI bacterial PLUS ELITe kit was launched by ELITech group showcasing significant achievement that affects the market positively. This kit is designed for a specific purpose which can detect bacterial pathogens leading to GI infections in many patients.

Launch of Novel tests ; Another driving factor for the market is the introduction of highly precise and novel clinical laboratory tests has witnessing surge in the market. Technological advancement in the context of portability, cost effectiveness and precise nature have been highly impacting the market's growth. For instance, in March 2023 US FDA approved grant to Abbott for its novel laboratory traumatic brain injury blood tests in the unites states. This move is expected to augment the market's growth further.

Opportunities in the Market

Advanced systems creating wave in the market

The major opportunity that, in vitro diagnostics market holds is the introduction of advanced systems which help to streamline workflow process to aid labs to gain more precise results within less time than other conventional methods which allows staff to focus on more critical cases. For instance, in July 2023, Atellica CI analyzer has been developed and launched by Simens healthineers. It is a compact and precise testing system particularly designed for clinical chemistry testing and immunoassay which aims to solve challenges like labor shortages, accuracy issues and time-consuming tests. The analyzer also received a Clearnce from U.S. FDA.

In Vitro Diagnostics Market Segmentation

By Product

By product, reagent segment accounted for the largest market share 2024, hence dominating the global market. The segment is anticipated to retain its dominance during foreseeable period due to major players collaborating with each other to develop novel drugs for various diseases and increasing investment in R&D by government and research institutes further augmenting the market. For instance, in March 2023 Servier and QIAGEN made collaboration to develop test known as TIBSOVO to treat blood cancer.

By product, the instruments segment expected to witness the fastest growth rate. The growth of this segment can be related to the increasing rate of approval for novel in vitro diagnostics instruments. For instance, in March 2022, the Ion torrent Genexus Dx integrated sequencer was launched by thermos fisher scientific for both diagnostic and research purposes.

By Technology

By technology, immunoassay accounted for the largest market share in 2024, dominating the global market. The segment is growing due to increasing need for early diagnosis and rising rate of chronic and communicable diseases across the globe. Methods like enzyme linked immunosorbent assays are increasing in the market, fueling the segments growth.

By technology, coagulation is registered as the fastest growing segment in the global market. The growth of this segment is due to rising incidences of cardiovascular diseases, blood related diseases along with autoimmune diseases. Intruments like xprecia stride coagulation analyzer are expected to enhance overall workflow to detect the disease.

By End Use

By end use, the hospital segment accounted for the largest market share. The growth of this segment can be attributed to the increasing development in infrastructure to support patients' recovery faster and increasing initiatives by government authorities are expected to increase existing facilities of the segment. Increasing demand for hospital based IVD tests is propelling the segment further.

By end use, the homecare segment expected to witness the fastest growth rate in the market. The growth of this segment can be related to the increasing inclination of people for convenient treatments at home and increasing geriatric population which are unbale to move due to age related factors are fueling the segment further. Developed nations such as United States, Canada and multiple Asian as well as European countries are observed to adapt homecare settings for variety of causes, this is estimated to boost the segment’s expansion.

By Application

By application, the infectious disease segment accounted for the largest market share, dominating the global market. The segment is expanding due to the outbreak of infectious diseases across the globe. Major players are also launching novel products for testing to increase services for patients and healthcare professionals. For instance, in Feb 2023, US FDA has approved EUA for BD, to new molecular diagnostic combination test.

By application, the oncology segment is expected to witness the fastest growth rate in the upcoming year. The growth of oncology segment is due to rising incidences of various cancers along with high rate of mortality highlighting the importance to treat these symptoms early. Rising approval for novel tests, high investments by R&D and supportive initiatives taken by government are prime factors augmenting the segments growth.

By Test Location

By test location, the lab-based test accounted for the largest market share, dominating the global market. Lab-based test segment is proliferating due to its high precision, and fast results performed by professionals which are more reliable than home kit test that may fail to show accurate results. Also, sample collection has become easy and is another major factor affecting the market's growth.

By test location, the homecare segment anticipated to witness the fastest growth rate in the global market. The growth of this segment is due to its increasing reliability and patient-centric approach making it more in demand. For instance, to test urinary tract infection, in April 2023, LIusen scientific, a university of south wales spinoff launched a molecular diagnostic platform, known as lodestar Dx platform.

Regional Insights

The North America accounted for the largest market share, thus dominating the global in vitro diagnostics market. The growth of this region can be attributed to the factors like increasing chronic conditions rate, presence of leading market players and increasing rate of novel tests. For instance, in Jan 2023 EUA has been received by both BD and CerTest biotec from US FDA for PCR test to detect Mpox virus. The increasing incidences of genetic testing and customized healthcare like diabetes and cancer treatment is augmenting the region's growth on a large scale.

Europe is the fastest growing region in the global market. The growth of this region can be attributed to the factors like increasing testing for infectious diseases, molecular diagnostic tests and strong players like healthineers and Simens are Fuelling the region's demand. The stringent IVDR regulations to ensure accuracy and high-level safety for diagnostic tests are key reasons for markets growth in Europe. Country wise UK is experiencing robust growth rate due to high advancement in poi-of-care testing, molecular diagnostics and AI-based solutions, AI integration in diagnostics also helps to streamline workflow and helps to transfer data ins fastest way.

Asia Pacific In Vitro Diagnostics Market Trends

Asia Pacific in vitro diagnostics market is anticipated to exhibit significant growth at CAGR of 8.59% during the forecast period. The regional market of Asia Pacific is expected to be driven by a number of factors, some of which include the presence of stabilizing economies, a rapidly growing middle-class population, supportive government policies, and rapid urbanization across the region. For instance, in October 2023, Fapon and Halodoc partnered to increase the in vitro diagnostic products sales and services in Indonesia. Moreover, leading players are collaborating with regional players to expand their reach in developing countries in Asia Pacific.

In vitro diagnostics market in China is expanding rapidly, driven by a rising demand for molecular diagnostics, point-of-care testing, and digital health integration. Molecular diagnostics, especially in infectious diseases and oncology, are seeing significant growth due to public health initiatives and increased healthcare spending. Point-of-care testing is gaining momentum in rural and community health settings, providing accessible diagnostic options. Additionally, digital health and AI-driven diagnostics are being integrated to improve patient outcomes, streamline diagnostics, and support the country’s healthcare modernization efforts.

Japan in vitro diagnostics market is experiencing growth spurred by an aging population and advancements in personalized medicine. Key trends include the rising use of molecular diagnostics, particularly for oncology and genetic testing, as these help identify targeted treatments for age-related diseases. Automation and AI integration in diagnostic labs are also enhancing efficiency and accuracy, which is crucial given Japan’s limited healthcare workforce. Furthermore, there’s an increased demand for point-of-care testing, especially in home and community health settings, supporting proactive and preventive healthcare.

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Browse More Research Reports ;

Biotechnology Market : The global biotechnology Market size was estimated at USD 1.95 trillion in 2024 and is projected to hit around USD 5.90 trillion by 2034, growing at a CAGR of 11.7% during the forecast period from 2025 to 2034.

Clinical Trials Market : The global clinical trials market size accounted for USD 120.98 billion in 2024 and is expected to exceed around USD 186.09 billion by 2034, growing at a CAGR of 4.4% from 2024 to 2034.

U.S. Oncology Clinical Trials Market : The U.S. oncology clinical trials market size is calculated at USD 7,919 million in 2024 and is predicted to reach around USD 12,416 million by 2034, expanding at a CAGR of 4.6% from 2024 to 2034.

Non-Alcoholic Steatohepatitis Clinical Trials Market : The global non-alcoholic steatohepatitis clinical trials market size accounted for USD 2,831 million in 2024 and is expected to exceed around USD 5,621 million by 2034, growing at a CAGR of 7.1% from 2024 to 2034.

U.S. Clinical Trials Support Services Market : The U.S. clinical trials support services market size is calculated at USD 10.19 billion in 2024 and is predicted to reach around USD 22.22 billion by 2034, expanding at a CAGR of 8.11% from 2024 to 2034.

Recent Developments

- In January 2024, Cepheid 's Xpert Xpress MVP received FDA clearance and CLIA waiver, offering rapid multiplex PCR testing for Bacterial Vaginosis (BV), Vulvovaginal Candidiasis (VVC), and Trichomoniasis (TV), improving targeted treatment and patient outcomes in near-patient settings.

- In Nov 2023, Illumina and Veracyte both made collaboration to developed molecular test precisely for decentralized IVD applications. Companies are focusing on developing swab tests.

- In December 2023, ARUP Laboratories and Medicover collaborated to provide diagnostic and healthcare services in Europe. ARUP Laboratories has developed AAV5 DetectCDx in collaboration with BioMarin Pharmaceutical Inc. to select therapies for severe hemophilia A patients.

- In November 2023, Veracyte joined Illumina aimed to develop molecular tests for decentralized IVD applications. Companies are focusing on the development of Prosigna breast cancer and Percepta nasal swab tests of Veracyte.

- In October 2023, Promega Corporation announced its plan to develop and commercialize companion diagnostics kits with GSK plc to identify cancer patients with MSI-H solid tumors.

- In February 2023, Unilabs announced investing over USD 200 million in Siemens Healthineers ' technology and acquiring more than 400 laboratory analyzers to strengthen its laboratory infrastructure.

- In February 2023, F. Hoffmann-La Roche Ltd. collaborated with Janssen Biotech Inc. to develop companion diagnostics for targeted therapies. Companion diagnostic technologies include digital pathology, NGS, PCR, immunoassays, and immunohistochemistry.

in vitro diagnostics Market Top Key Companies:

- Abbott

- bioMérieux SA

- QuidelOrtho Corporation

- Siemens Healthineers AG

- Bio-Rad Laboratories , Inc.

- Qiagen

- Sysmex Corporation

- Charles River Laboratories

- Quest Diagnostics Incorporated

- Agilent Technologies , Inc.

- Danaher Corporation

- BD

- F. Hoffmann-La Roche Ltd.

Global In Vitro Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Statifacts has segmented the global in vitro diagnostics market report based on the products, technology, application, end-use, test location, and region.

- By Product

- Instruments

- Reagents

- Services

- By Technology

- Immunoassay

- Instruments

- Reagents

- Services

- Hematology

- Instruments

- Reagents

- Services

- Clinical Chemistry

- Instruments

- Reagents

- Services

- Molecular Diagnostics

- Instruments

- Reagents

- Services

- Coagulation

- Instruments

- Reagents

- Services

- Microbiology

- Instruments

- Reagents

- Services

- Others

- Instruments

- Reagents

- Services

- Immunoassay

- By Application

- Infectious Diseases

- Diabetes

- Oncology

- Cardiology

- Nephrology

- Autoimmune Diseases

- Drug Testing

- Others applications

- By Test Location

- Point of Care

- Home-care

- Others

- By End-use

- Hospitals

- Laboratory

- Home-care

- Others

- By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Elevate your business strategy with market-driven insights—purchase the report today (Price USD1550) https://www.statifacts.com/order-report/7792

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

About US

In a world drowning in data, where every decision feels like a gamble, there's a place where clarity reigns supreme. A place where insights are not just found but created. Welcome to Statifacts, where we transform raw numbers into actionable strategies, and where every piece of data offers a deep dive into industry’s insights.

We believe in data with a heartbeat. Numbers should be more than just figures on a screen; they should pulse with the life of your market, echoing the trends, the shifts, the opportunities that are just around the corner. Our statistics are curated, crafted, and delivered in a way that speaks directly to you, helping you make sense of the noise and find the signal that matters..

For Latest Update Follow Us:

Statifacts | Precedence Research| Towards Healthcare