Smallcaps have the highest dividends in the entertainment sector

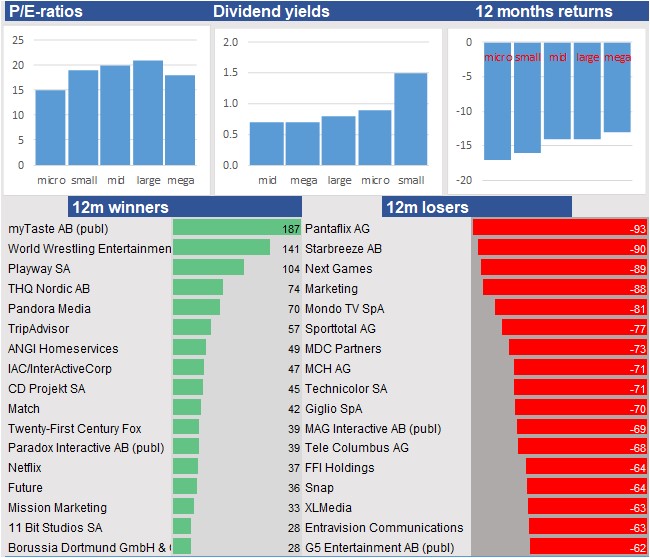

Within the entertainment sector, we see a low diversification of the 12-months returns. Since December last year the sector is around 15 percent lower. Among the winners we find myTaste AB (publ), World Wrestling Entertainment and Playway SA. Relatively big losses were for Pantaflix AG, Starbreeze AB and Next Games.

Core figures entertainment sector

The winners in this sector are the megacaps, while microcaps are mostly among the less performers.

Lowest PE-ratios entertainment sector

Regarding the price/earnings-ratios we see a uniform palette. The large caps are with the price/earnings-ratio of 21 the most expensive. The microcaps are the cheapest and trade at 15 times the earnings per share. Reach, Manchester United and ANGI Homeservices are the stocks with the highest ratios. Stocks with the lowest ratios are Marketing, Townsquare Media and Impresa Sociedade Gestora de Participacoes Sociais SA.

Highest dividend yields entertainment sector

The sector's average dividend yield is with 0.9 percent relatively limited. Stocks now high dividend yields now are New Media Investment, Telenet Holding NV and Atresmediaoracion de Medios de Comunicacion SA.

This is a free publication from Valuespectrum Pro. Valuespectrum Pro is a professional platform with analyses from all US and European companies. Click here to sign up for free.