The Eurozone Crisis and Its Contagion Effects on the European Stock Markets

Contagion effects

A recent research The Eurozone Crisis and Its Contagion Effects on the European Stock Markets made by the Financial Studies Department from University of Delhi, India, checks the contagion effects of GIPSI (Greece, Ireland, Portugal, Spain and Italy) along with USA’s stock markets on 13 markets - seven of them from Eurozone, six of them outside the European Monetary Union. The study was based on the dynamic cross market conditional correlations between stock markets and the contagion was measured by applying time-varying conditional correlation model of Engle.

Even if Eurozone is seen as one of the world’s strongest economic unions and generally presents a homogenous growth and development, after the outbreak of Eurozone crisis plenty of concerns have appeared regarding its sustenance under the pressure of recent crisis in GIPSI economies. The study identifies the crisis period in case of GIPSI markets as from October 19, 2009 to January 31, 2012.

The empirical results lead to the conclusion that financial contagion is generated by a “herding behavior” in the financial markets of sample Eurozone and Non-Eurozone markets. Spain, Italy, Portugal and Ireland appear to be the most contagious among GIPSI stock markets for the Eurozone and Non- Eurozone markets. The most vulnerable countries to the contagion shock seem to be Austria, Belgium, France, and Germany, from the Eurozone block, and United Kingdom, Denmark, and Sweden from the Non-Eurozone group.

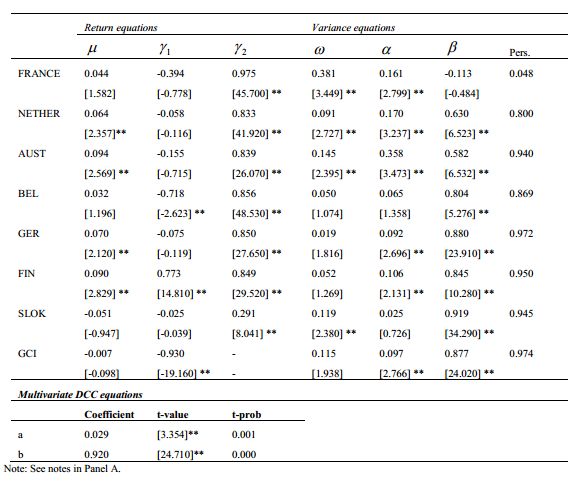

Table 6. Dynamic conditional correlation results Panel A: GCI-Eurozone

The study finds that from global investors’ perspective, the EU based diversification strategies are likely to be inefficient, or at least they were during the Eurozone crisis, because of the investors’ strong herding behavior triggered by financial contagion. The authors even advance the theory that Eurozone markets might be even less viable in strategic asset distribution than Non-Eurozone markets, because of a stronger contagion with GIPSI counties and a common currency that generates greater monetary coordination.