2008 best year, 2009 worst year for Roche

Roche-investors have very profitable for long times. Even without dividend payments the stock is one of the outperformers from as well pharmaceutical sector as the Swiss exchange. The received dividends are a cherry on the cake for investors.

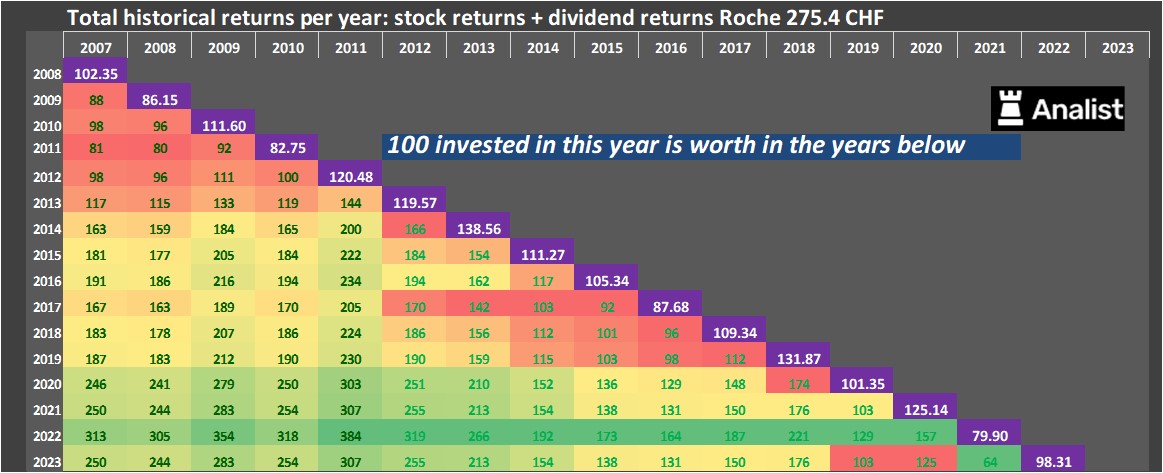

The matrix above shows Roche 's historical returns expressed in the different entry years in the left axis.

The year 2009 is (measured since 2008) with a price loss of 69 percent which makes it the stock's worst year. The best year for the stock was 2008. The stock gained no less than 21 percent in the period. Investors who invested in the share in 2008 (price at that time 162.5) CHF now even have a price gain of 41 percent.Tomorrow the Swiss company Roche will publish its past quarters results. For this year the company from could earn a total revenue around 61.46 billion CHF. This is according to the average of the analysts' estimates. This is slightly lower than 2022's revenue of 63.28 billion CHF.

Historical revenues and results Roche plus estimates 2023

The analysts expect for 2023 a net profit of 15.4 billion CHF. The majority of the analysts expects for this year a profit per share of 19.52 CHF. Based on this the price/earnings-ratio is 14.11.

Huge dividend Roche

Per share the analysts expect a dividend of 9.67 CHF per share. Thus the dividend yield equals 3.51 percent. The average dividend yield of the pharmaceutical companies equals an attractive 2.07 percent.Newest target prices around 300 CHF

The most recent recommendations for the pharmaceutical company are from Morgan Stanley , UBS and Goldman Sachs .Based on the current number of shares Roche 's market capitalization equals 176.37 billion CHF.

Historical stock prices Roche period 2007-2023

At 15.07 the stock trades 0.04 percent lower at 275.4 CHF.

Analist.nl Nieuwsdienst: +31 084-0032-842

nieuws@analist.nl

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. Analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.