Twitter Stock: Are There Any Growth Catalysts?

Twitter stock is gaining ground today after J.P. Morgan upgraded the stock to Overweight from Neutral, with a price target of $65. The firm’s analyst Doug Anmuth said that Twitter will rebound after suffering an advertising decline in 2020 amid the pandemic. The analyst said that Twitter stock is “under owned,” and added the stock in J.P. Morgan’s top picks of 2021 list.

The analyst also said that Twitter stock is undervalued when compared to its peers like Snap and Pinterest.

Twitter stock is also benefitting from a new report which said that Snapchat is planning to launch a native feature will embed tweets in Snapchat stories. This feature will bring new customers from Snapchat to Twitter.

Expectations Twitter

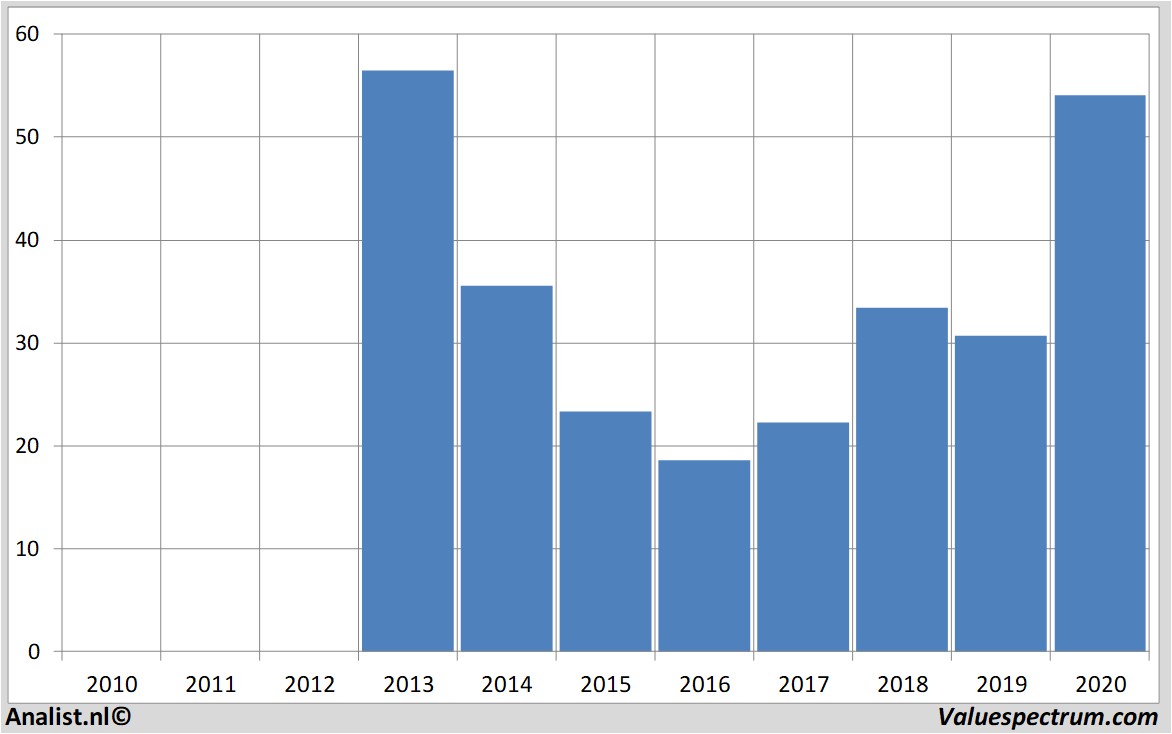

Over the current book year the total revenue from the company in San Francisco will be 3,61 billion USD (consensus estimates). This is slightly more than 2019's revenue of 3,46 billion USD.

Historical revenues and results Twitter plus estimates 2020

Twitter

TwitterThe analysts expect for 2020 a net loss of 474 million USD. For this year the majority of the analysts, consulted by press agency Thomson Reuters, expects a loss per share of 71 cent. The PE-ratio therefore is -76,1.

Analysts don't expect the company to pay a dividend. The average dividend yield of the internet companies is a moderate 0,32 percent.

Twitter 's market capitalization is based on the number of outstanding shares around 41,29 billion USD. The Twitter stock was the past 12 months quite unstable. Since last December the stock is even 71 percent higher. This year the stock price moved between 20 and 56 dollar.

Historical stock prices Twitter

Click here for dividend Twitter Inc. On Wednesday, the stock closed at 54,03 USD.

Analist.nl Nieuwsdienst: +31 084-0032-842

nieuws@analist.nl

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. Analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.