Buy Micron Technology, Inc.(MU) Before 2018

Micron Technology , Inc.(NASDAQ:MU) went through the roof in 2017 amid skyrocketing NAND and DRAM prices. Micron Technology ’s revenue in the fourth quarter increased by over 90%. Analysts think that Micron Technology stock will keep gaining value despite some predictions suggesting an incoming slump in memory prices. JPMorgan recently brushed aside the fears that there will be an oversupply of memory chips in China.

Stifel’s analyst Kevin Cassidy also gave a bullish rating for Micron Technology stock with a price target of $65. Barclays analyst Blayne Curtis also believes that Micron Technology stock will rise in 2018 on the back of a massive demand of flash memory chips. Micron Technology has cut its dependence on memory prices over the last few months. The company’s chips are being used in self-driving cars chips. Nvidia will soon launch its DRIVE PX2 platform, whose hardware is powered by Micron Technology , Inc.(NASDAQ:MU). In the coming years, self-driving chips business will become a big revenue stream for Micron Technology .

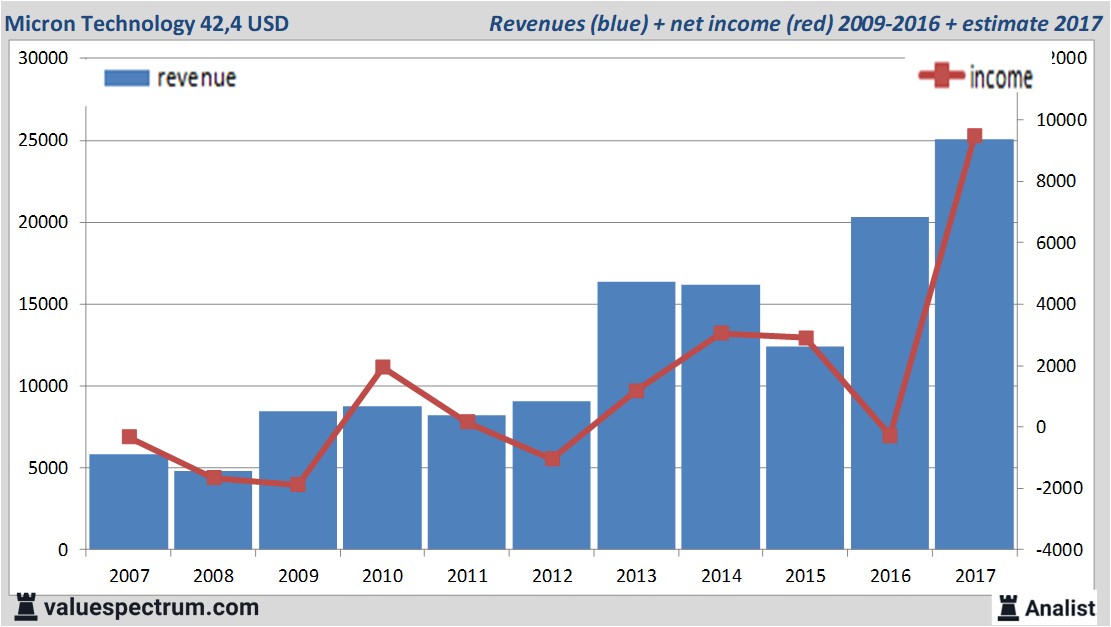

Based on the analysts' consensus: both the revenue and the net result would be on record levels. For this year Micron Technology 's revenue will be around 25,04 billion USD. This is according to the average of the analysts' estimates. The expected revenue would be a record for the company. This is rather significant more than 2016's revenue of 20,32 billion USD.

Historical revenues and results Micron Technology plus estimates 2017

The analysts anticipate for 2017 a record net profit a 9,45 billion USD. For this year the majority of the analysts, consulted by press agency Thomson Reuters, expects a profit per share of 7,87 USD. The price/earnings-ratio is then 5,24.

For this year the analysts expect a dividend of 0,13 cent per share. The dividend yield is then 0,32 percent. The average dividend yield of the semiconductor companies is a moderate 0,24 percent.

Recent target prices around 54 USD

The most recent recommendations for the semiconductor company are from UBS , Barclays and Credit Suisse . Micron Technology 's market value equals around 42,86 billion . At 15.35 the stock trades 1,07 percent lower at 41,21 USD.Historical stock prices Micron Technology period 2007-2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.