Analysts think Starbucks Corporation (SBUX) Will Rebound

Starbucks Corporation(NASDAQ:SBUX) was hammered last week after the coffee company missed revenue estimates for the third quarter. Investors also fear a slowing growth for Starbucks in the US because the company cut its forecasts. But analysts think that Starbucks will be able to come out of its crisis amid a huge opportunity in China, digital growth and new menu items.

Starbucks has almost no competitor in China. The company has a comparable sales of 5%, which is better than any other coffee company in the US. These factors will make the stock gain value in the future.

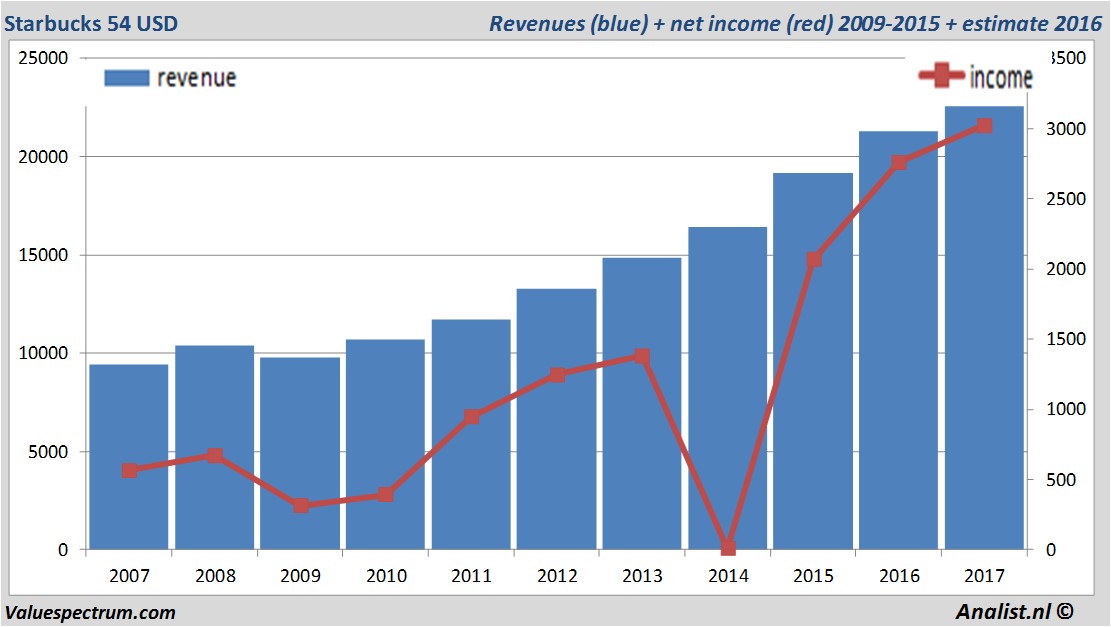

Based on the analysts' consensus: both the revenue and the net result would be the highest in years. Over the current book year the total revenue will be 22,54 billion USD (consensus estimates). The expected revenue would be a record for the company. This is slightly more than 2016's revenue of 21,32 billion USD.

Historical revenues and results Starbucks plus estimates 2017

The analysts anticipate for 2017 a record net profit a 3,02 billion USD. For this year the majority of the analysts, consulted by press agency Thomson Reuters, expects a profit per share of 2,08 USD. The price/earnings-ratio therefore equals 25,96.

For this year the analysts expect a dividend of 1 USD per share. Thus the dividend yield equals 1,85 percent. The average dividend yield of the beverage companies equals a limited 0,57 percent.

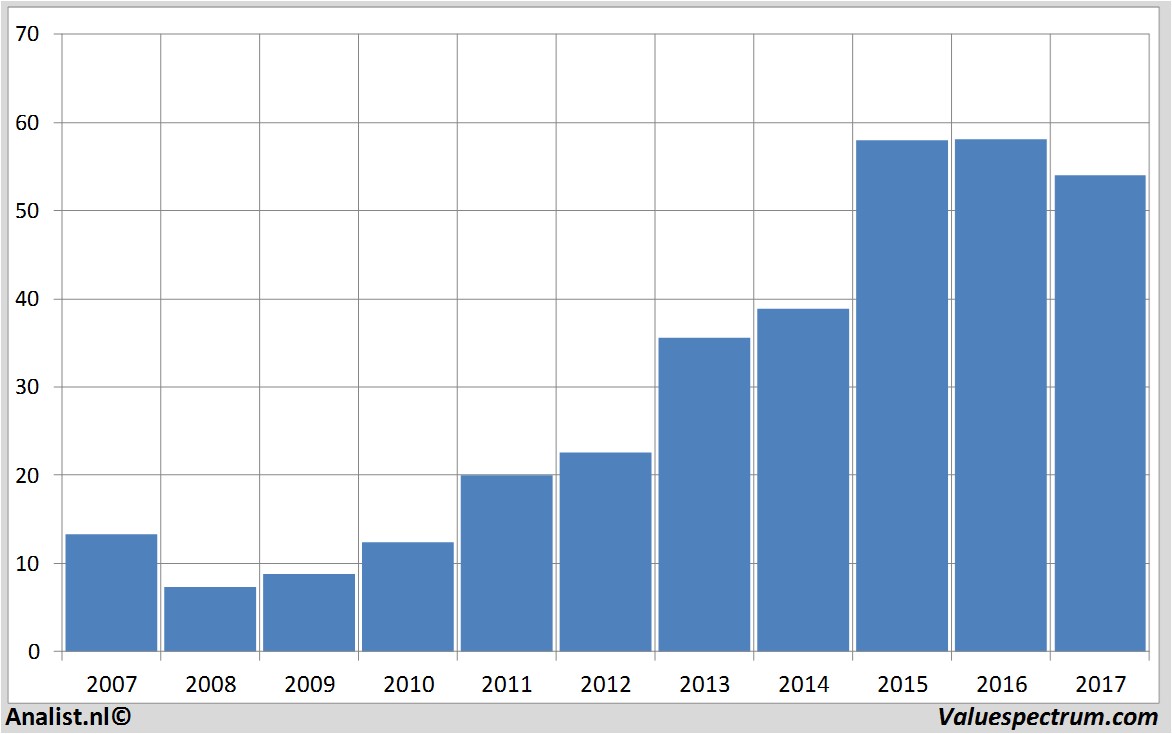

Latest estimates around 65 USD

The most recent recommendations for the beverage company are from Wedbush Morgan Securities, Deutsche Bank and Barclays . Based on the current number of outstanding shares Starbucks 's market capitalization 80,2 billion USD. At 16.40 the stock trades 0,19 percent higher at 54 USD.Historical stock prices Starbucks from 2007 till 2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.