Share Wolters Kluwer for years among Dutch outperformers

The past years Wolters Kluwer gained a lot in value. The stock belongs because of her strong price gain of 397 percent over the past 10 year to one of the best shares of the Dutch stock markets. Since the start of this year, the average Dutch stock has gained year around 132 percent in value. Other winners over the past 10 years are BE Semiconductor, ASML and Acomo.

Returns Wolters Kluwer versus Dutch stocks

Buy & hold Returns stock Wolters Kluwer several periods, excluding dividend returns

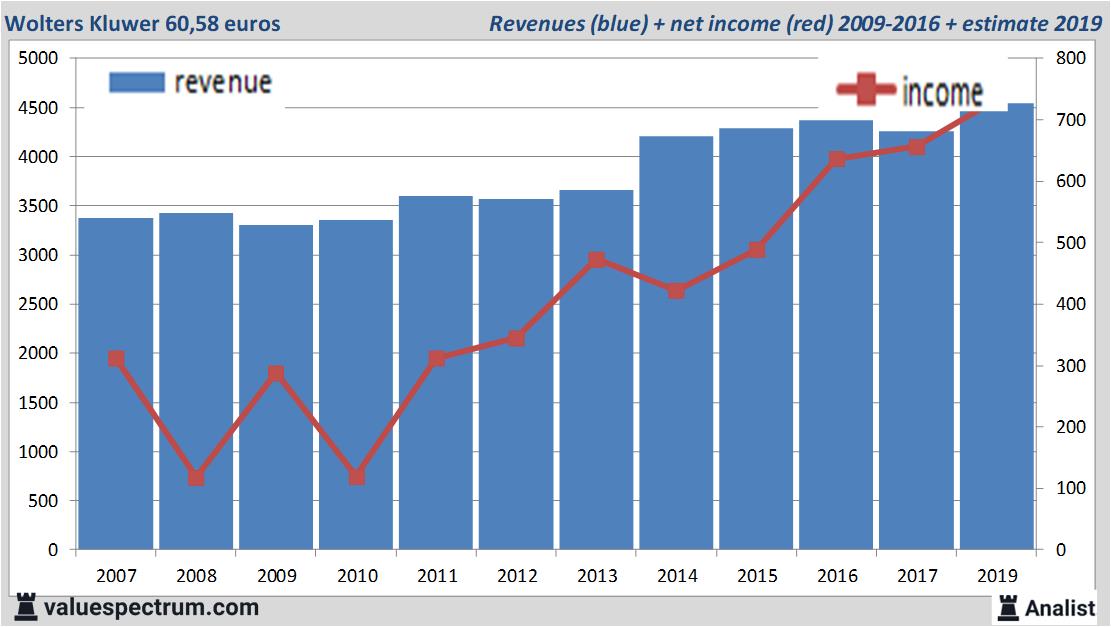

Since 2012 the stock has a price gain of 210 percent. over the past 90 days the stock made a profit of 7 percent.For this year Wolters Kluwer's revenue will be around 4,53 billion euros. This is according to the average of the analysts' estimates. This is slightly more than 2017's revenue of 4,26 billion euros.

Historical revenues and results Wolters Kluwer plus estimates 2018

The analysts expect for 2018 a net profit of 732 million euros. Most of the analysts anticipate on a profit per share of 2,7 euros. Based on this the price/earnings-ratio is 23,03.

Analysts expect a dividend of 1,04 euros per share. Wolters Kluwer's dividend yield thus equals 1,67 percent. The average dividend yield of the publishers is a moderate 1 percent.

Recent target prices around 57 euros

The most recent recommendations for the publisher are from Kepler Capital Markets, Societe Generale and Barclays.Based on the current number of shares Wolters Kluwer's market capitalization equals 17,5 billion euros. The Wolters Kluwer stock was the past 12 months quite unstable. Since last May the stock is even 41 percent higher. This year the stock price moved between 45 and 63 euro. Since 2008 the stock price is almost 397 percent higher.

Historical stock prices Wolters Kluwer period 2007-2018

On Tuesday the stock closed at 62,18 euros.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.