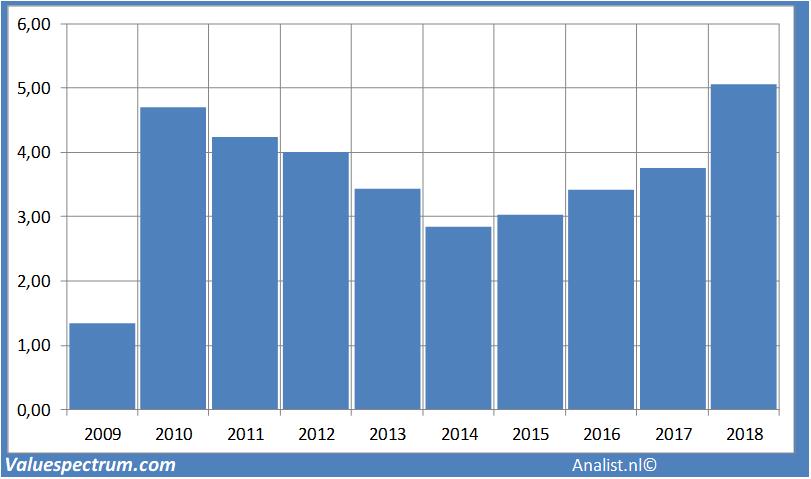

Extreme dividend yield Carnival

Investors in Carnival can expect a huge dividend payment. Based on the recent analysts' consensus the stock now has one of the highest dividend returns of the English market. For this year the analysts expect a dividend of 209 GBp per share. Carnival's dividend yield thus equals 5,05 percent. The average dividend yield of the travel & tourism companies equals a limited 0,5 percent.

Historical dividend returns Carnival

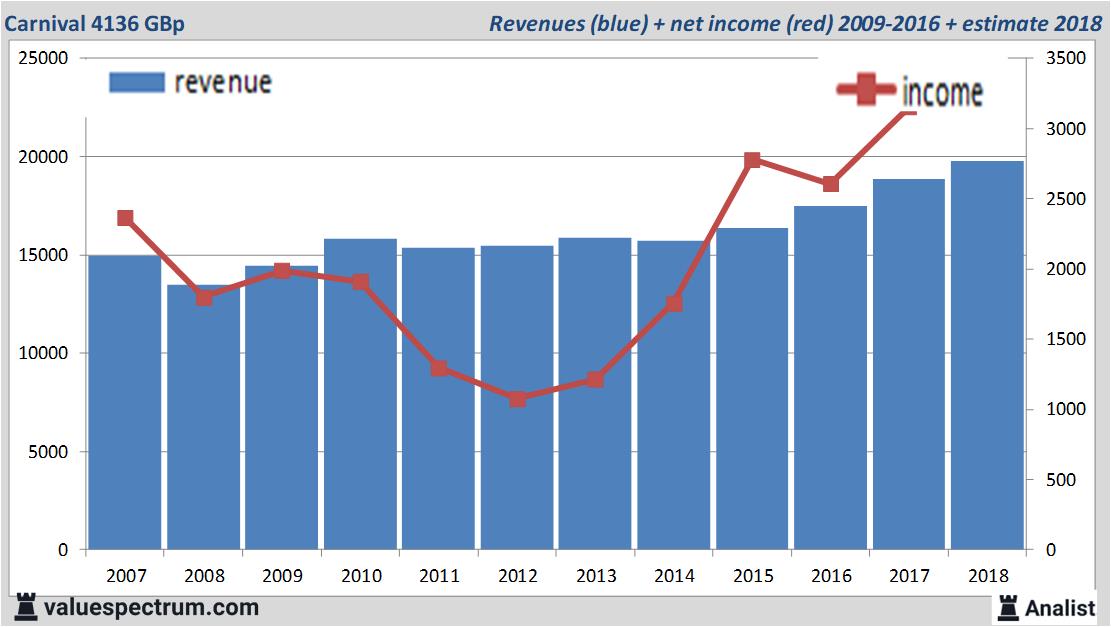

Next Monday the English Carnival will publish its past quarters figures. Over the current book year the total revenue will be 19,75 billion GBp (consensus estimates). This is slightly more than 2017's revenue of 18,88 billion GBp.

Historical revenues and results Carnival plus estimates 2018

The analysts expect for 2018 a net profit of 3,33 billion GBp. The majority of the analysts expects for this year a profit per share of 477 GBp. So the price/earnings-ratio equals 8,67.

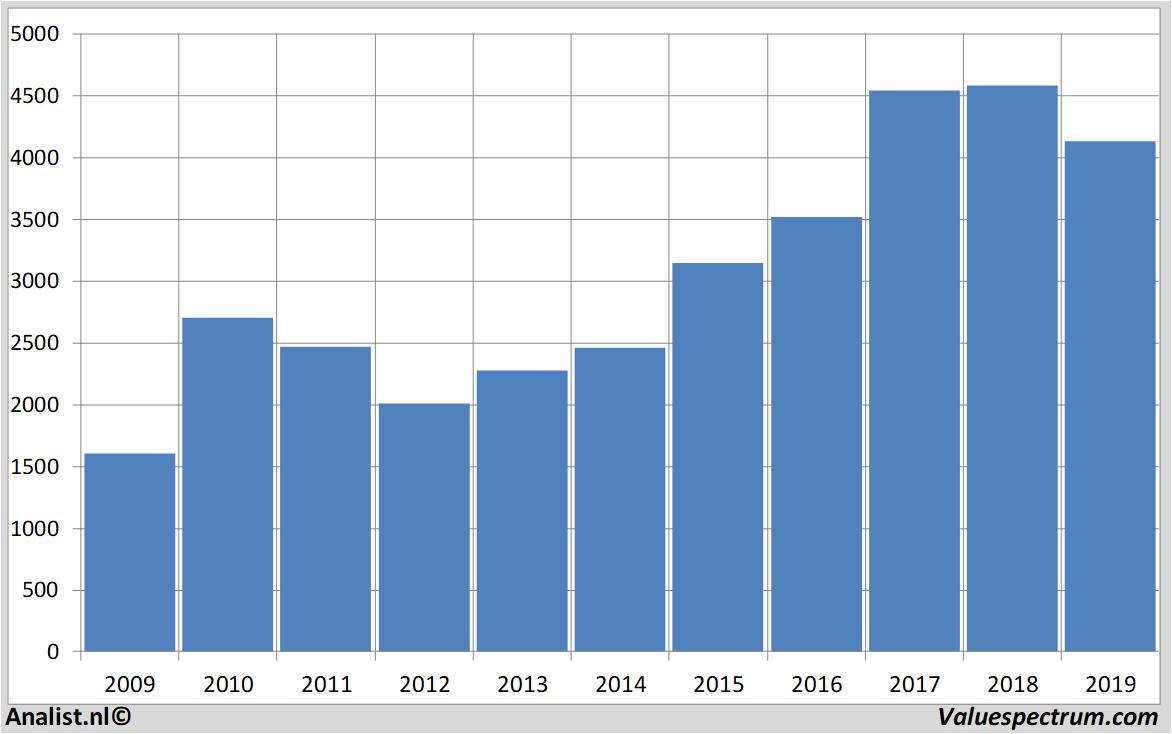

Latest estimates around 4710 GBp

The most recent recommendations for the travel & tourism company are from Morgan Stanley, Barclays and Berenberg.Based on the current number of outstanding shares Carnival's market capitalization 765,16 billion GBp. The Carnival stock was the past 12 months quite volatile. Since last March the stock is 7 percent lower. This year the stock price moved between 3611 and 5030 GBp. Since 2008 the stock price is almost 157 percent higher.

Historical stock prices Carnival2007-2018

On Friday the stock closed at 4136 GBp.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.