2012 best year, 2008 worst year for Nestle

Nestle -investors have very good for long times. Even without dividend payments the stock is one of the outperformers from as well food sector as the Swiss exchange. The received dividends are a cherry on the cake for investors.

The matrix above shows Nestle 's historical returns expressed in the different entry years in the left axis.

The year 2008 was the worst year for the company, with the stock losing about 20 percent in value. The year 2009 was the best one for the stock, as it gained 21 percent value in this period. Investors who bought the share in 2008 (price at that time 52 CHF) now even have a price gain of 90 percent.Over the current book year the total revenue will be 91,42 billion CHF (consensus estimates). This is slightly more than 2017's revenue of 89,79 billion CHF.

Historical revenues and results Nestle plus estimates 2018

The analysts expect for 2018 a net profit of 11,7 billion CHF. According to most of the analysts the company will have a profit per share for this book year of 3,82 CHF. So the price/earnings-ratio equals 20,7.

Huge dividend Nestle

Analysts expect a dividend of 2,49 CHF per share. Thus the dividend yield equals 3,15 percent. The average dividend yield of the food producers equals a limited 1 percent.Recent target prices around 94 CHF

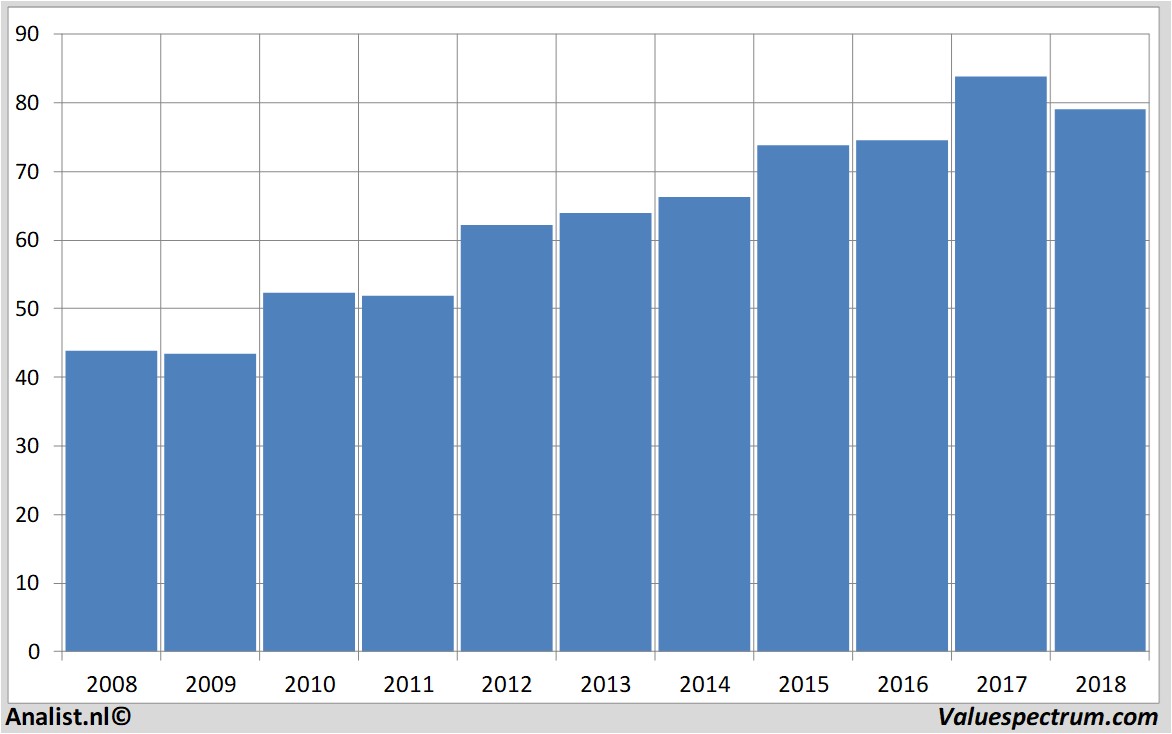

The most recent recommendations for the food producer are from Goldman Sachs , Jefferies & Co. and JP Morgan.Based on the current number of shares Nestle 's market capitalization equals 244,92 billion CHF. The Nestle stock was the past 12 months quite unstable. Since last October the stock is 2 percent lower. This year the stock price moved between 73 and 86 CHF. Since 2008 the stock price is almost 80 percent higher.

Historical stock prices Nestle period 2007-2018

At 17.30 the stock trades 1,22 percent lower at 79,06 CHF.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.