Neste Oil strong outperformer in European oil & gas sector

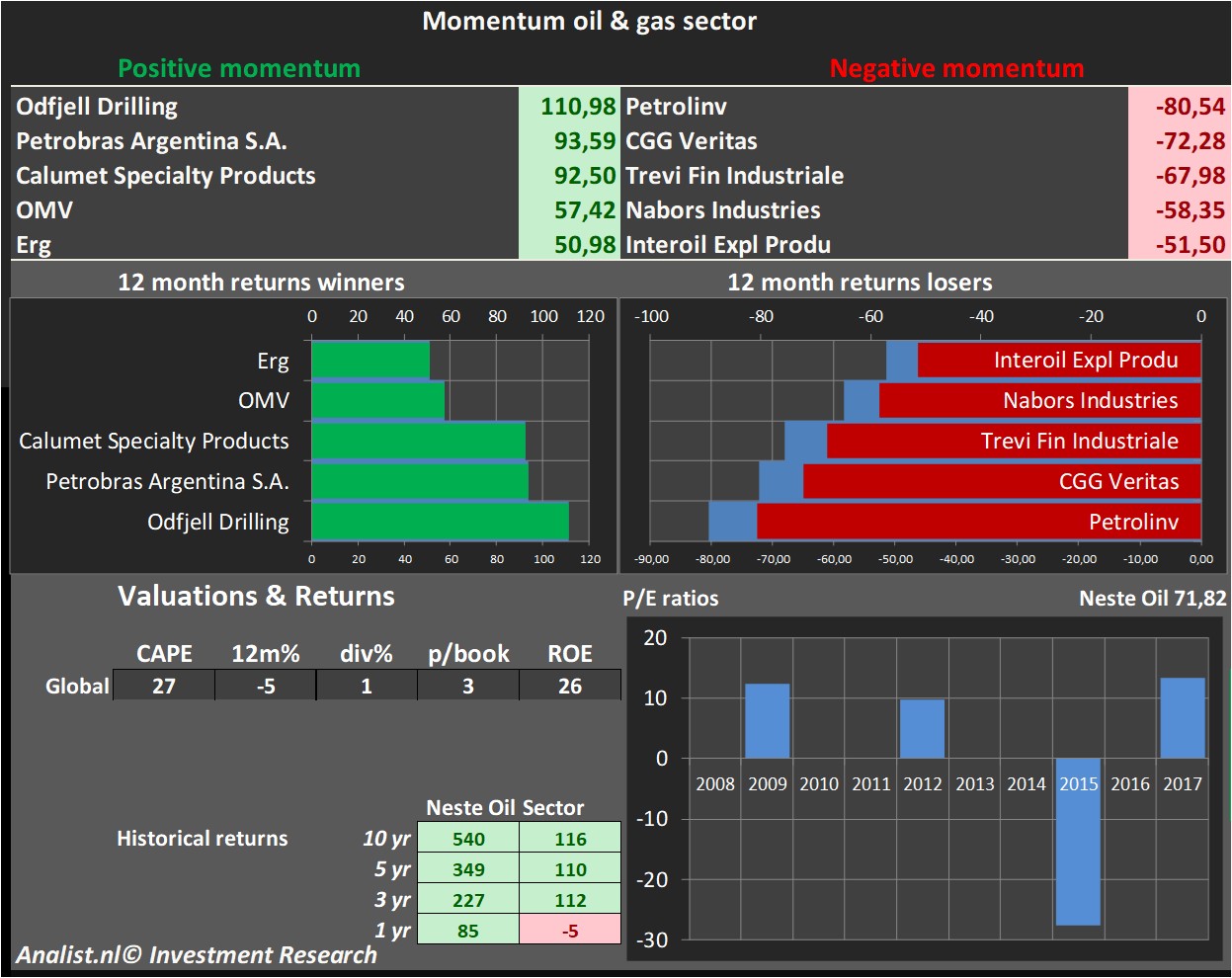

Due to the quite large return over the past year of 85 percent belongs to the top of the oil & gas producers. The average stock of the oil & gas sector yielded the past 1 year a loss of 5 percent. Other heavily winning shares of the sector are Odfjell Drilling, Petrobras Argentina S.A. and Calumet Specialty Products. Petrolinv , CGG Veritas and Trevi Fin Industriale are some of the winning stocks in the sector.

Momentum oil & gas sector

The sector trades now at 13 times the earnings per share. The sector trades at 3,29 times the book value per share. Since 2012 the sector has a profit of 110 percent and since 2007 a profit of 116 percent.

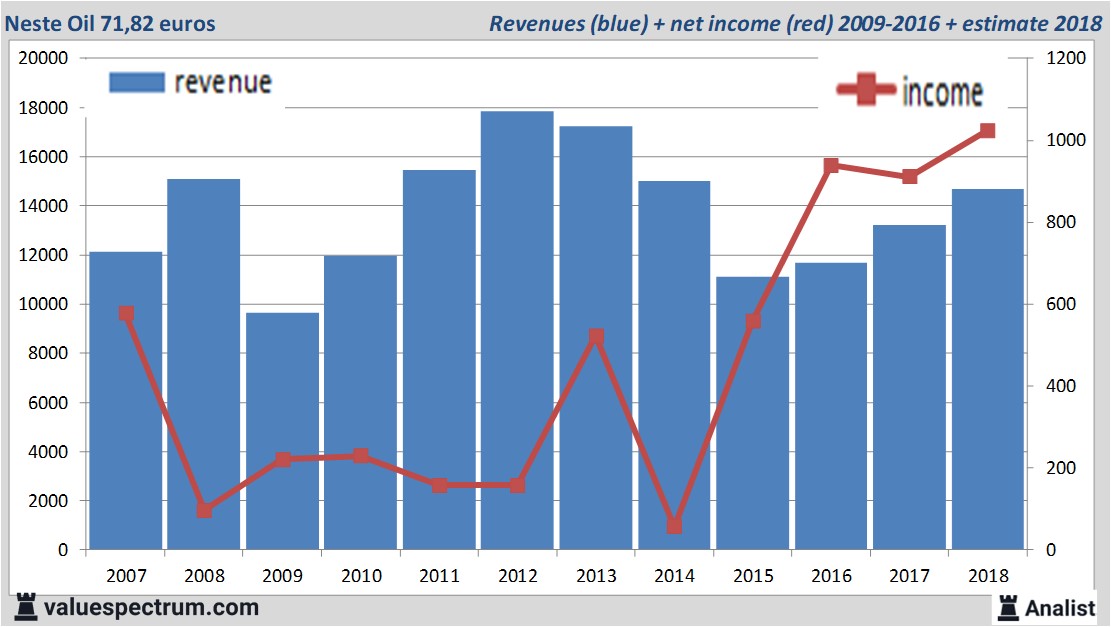

The sector trades now at 13 times the earnings per share. The sector trades at 3,29 times the book value per share. Since 2012 the sector has a profit of 110 percent and since 2007 a profit of 116 percent. For this year Neste Oil 's revenue will be around 14,68 billion euros. This is according to the average of the analysts' estimates. This is rather significant more than 2017's revenue of 13,22 billion euros.

Historical revenues and results Neste Oil plus estimates 2018

The analysts expect for 2018 a net profit of 1,02 billion euros. For this year the consensus of Neste Oil 's result per share is a profit of 3,99 euros. So the price/earnings-ratio equals 18.

For this year the analysts expect a dividend of 2,03 euros per share. The dividend yield is then 2,83 percent. The average dividend yield of the oil & gas producers is a low 1 percent.

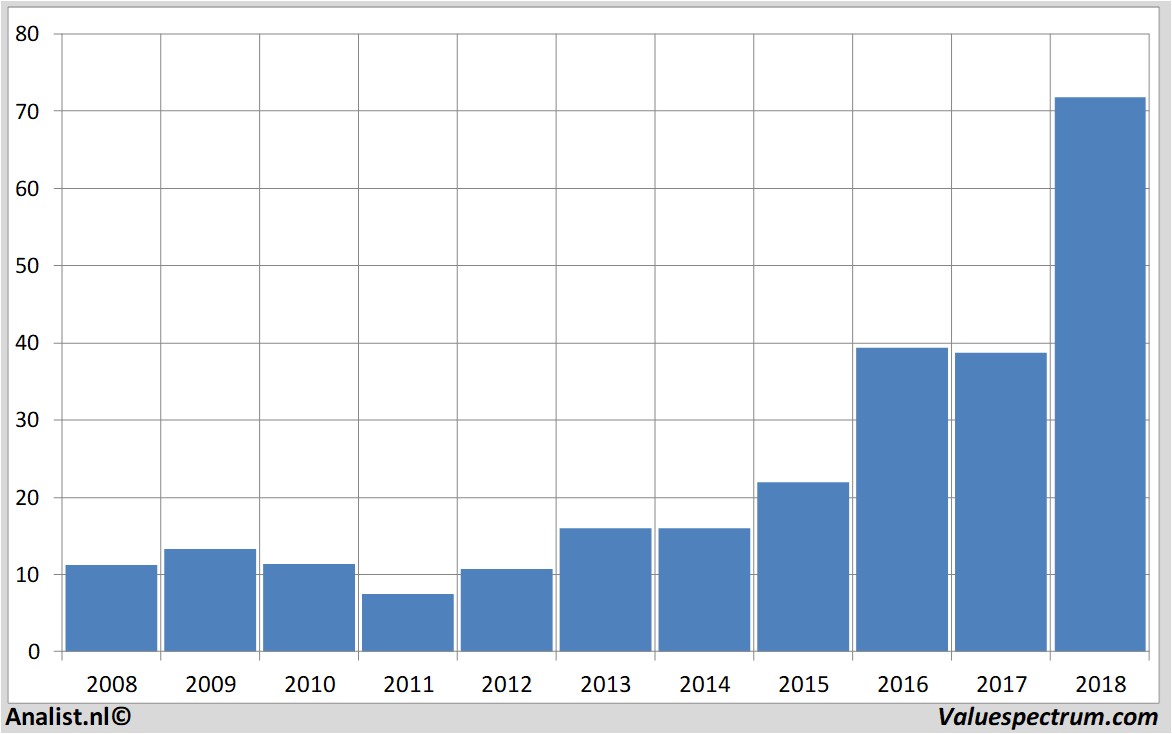

Based on the current number of outstanding shares Neste Oil 's market capitalization is 18,37 billion euros. The Neste Oil stock was the past 12 months quite volatile. Since last October the stock is even 84 percent higher. This year the stock price moved between 39 and 77 euro. Since 2008 the stock price is almost 540 percent higher.

Historical stock prices Neste Oil

At 18.00 the stock trades 3,34 percent higher at 71,82 euros.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.