Analysts: more sales United Rentals

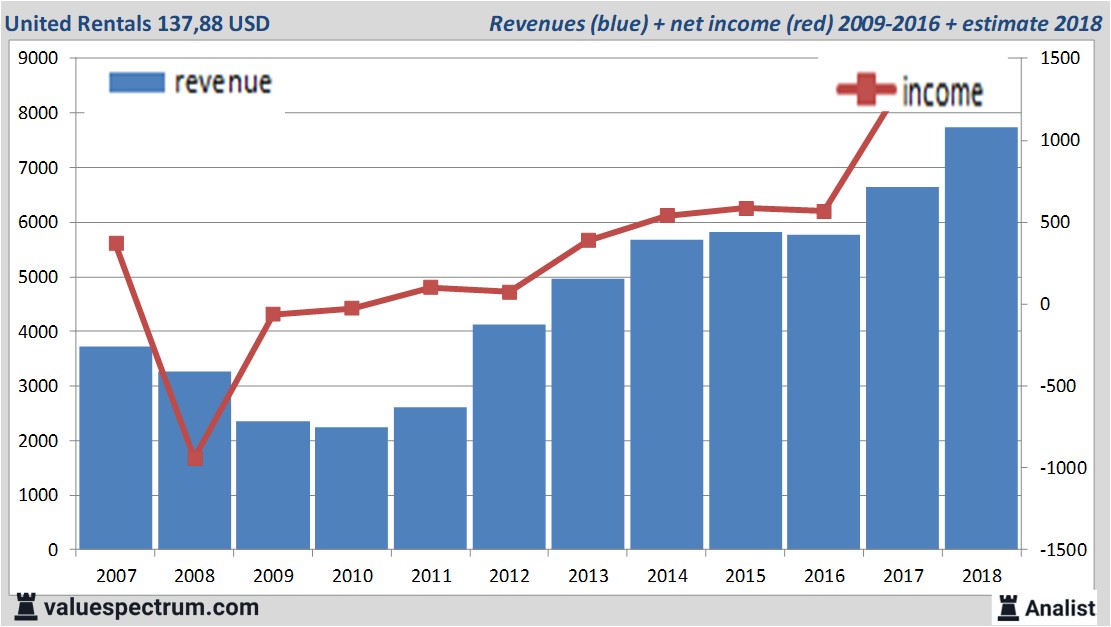

Over the current book year the total revenue will be 7,74 billion USD (consensus estimates). This is rather significant more than 2017's revenue of 6,64 billion USD.

Historical revenues and results United Rentals plus estimates 2018

The analysts expect for 2018 a net profit of 1,32 billion USD. For this year the consensus of United Rentals's result per share is a profit of 16,06 USD. So the price/earnings-ratio equals 8,59.

Analysts don't expect the company to pay a dividend. The average dividend yield of the industrial companies is a limited 1 percent.

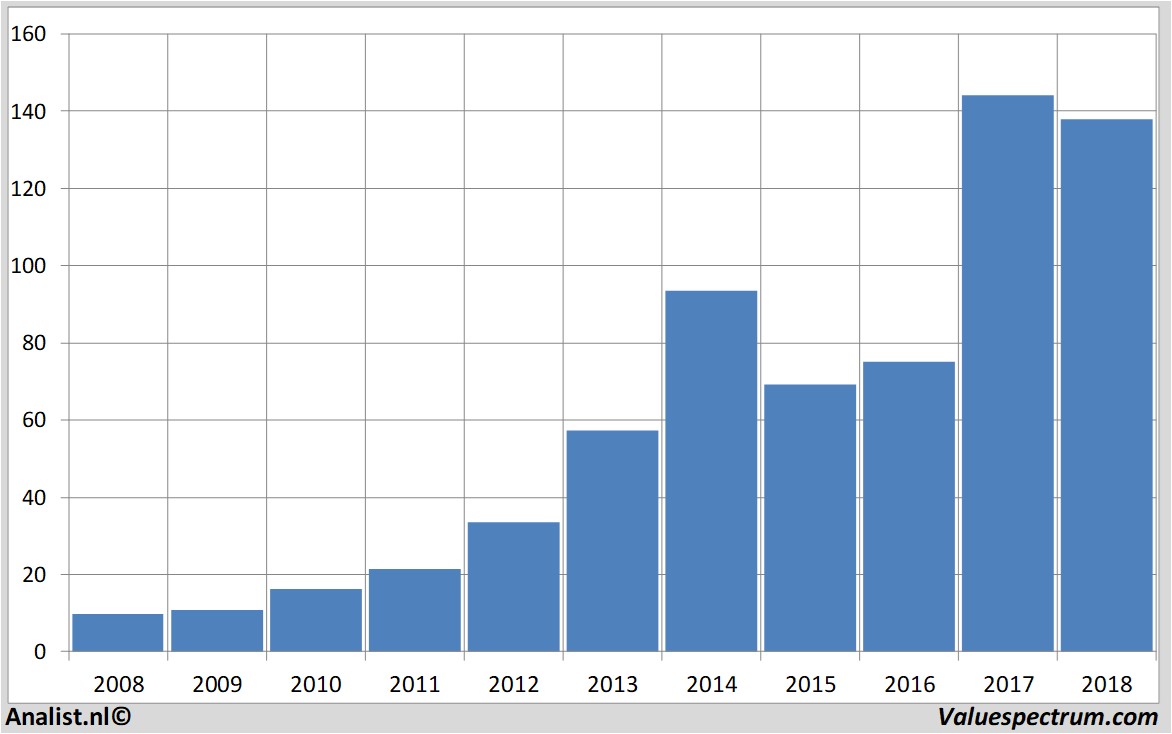

United Rentals's market value equals around 11,61 billion . The United Rentals stock was the past 12 months quite volatile. Since last October the stock is 4 percent lower. This year the stock price moved between 136 and 191 dollar. Since 2008 the stock price is almost 1303 percent higher.

On Friday, the stock closed at 137,88 USD.Historical stock prices United Rentals

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.