Eastman Chemical strong outperformer in chemical sector

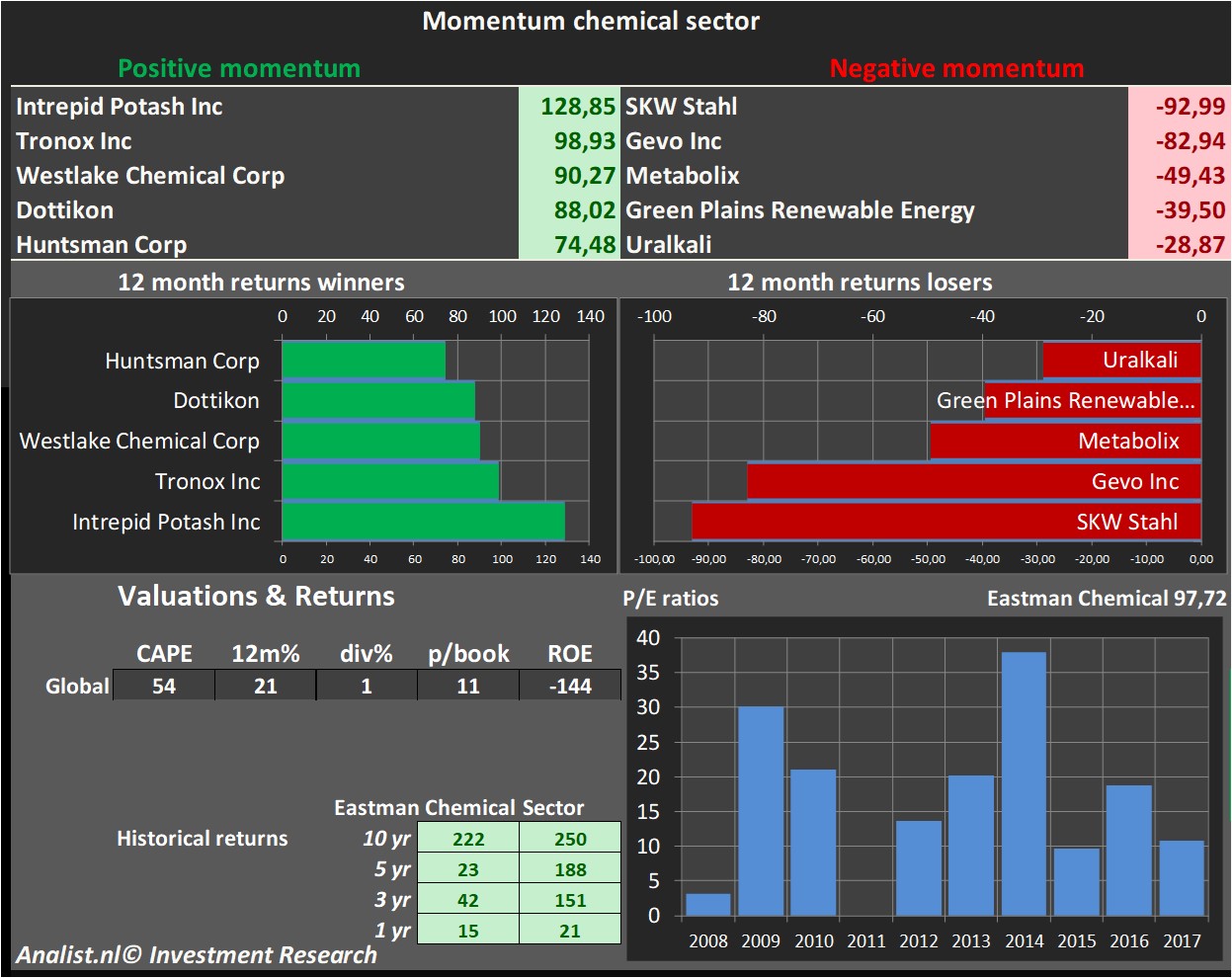

In the past years Eastman Chemical was a very good choice for investors. The stock was the past 10 years with a return of 222 percent one of the larger outperformers of her peer group. The average stock of the sector yielded the past 10 years a gain of 250 percent. The average stock of the chemical sector yielded the past 10 year a gain of 250 percent. Other strong winning shares of the sector are Intrepid Potash Inc, Tronox Inc and Westlake Chemical Corp. Among the outperformers in the sector are SKW Stahl , Gevo Inc and Metabolix.

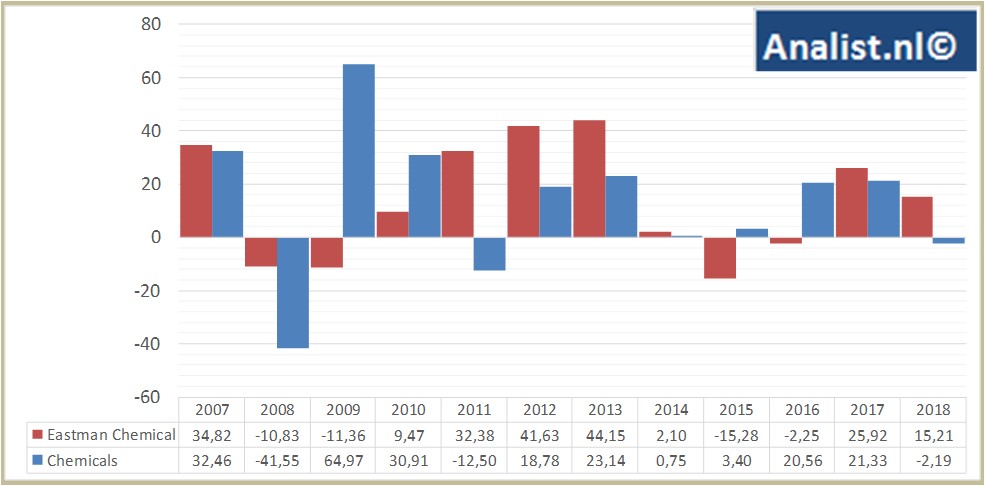

Returns Eastman Chemical versus chemical sector

Returns stock Eastman Chemical over several periods, excluding dividend returns

Investors who invested in 2007 in the company's share now have a massive profit of 222 percent. Since 2012 the stock has a price gain of 23 percent. over the past 90 days the stock made a loss of 6 percent.

Core figures American chemical sector

For the average share in the sector around 19 times the earnings per share is paid. Currently the sector trades at 11,08 times the book value per share. Since 2012 the sector has plus of 188 percent and since 2007 a plus of 250 percent.

For this year Eastman Chemical 's revenue will be around 10,21 billion USD. This is according to the average of the analysts' estimates. This is slightly more than 2017's revenue of 9,55 billion USD.

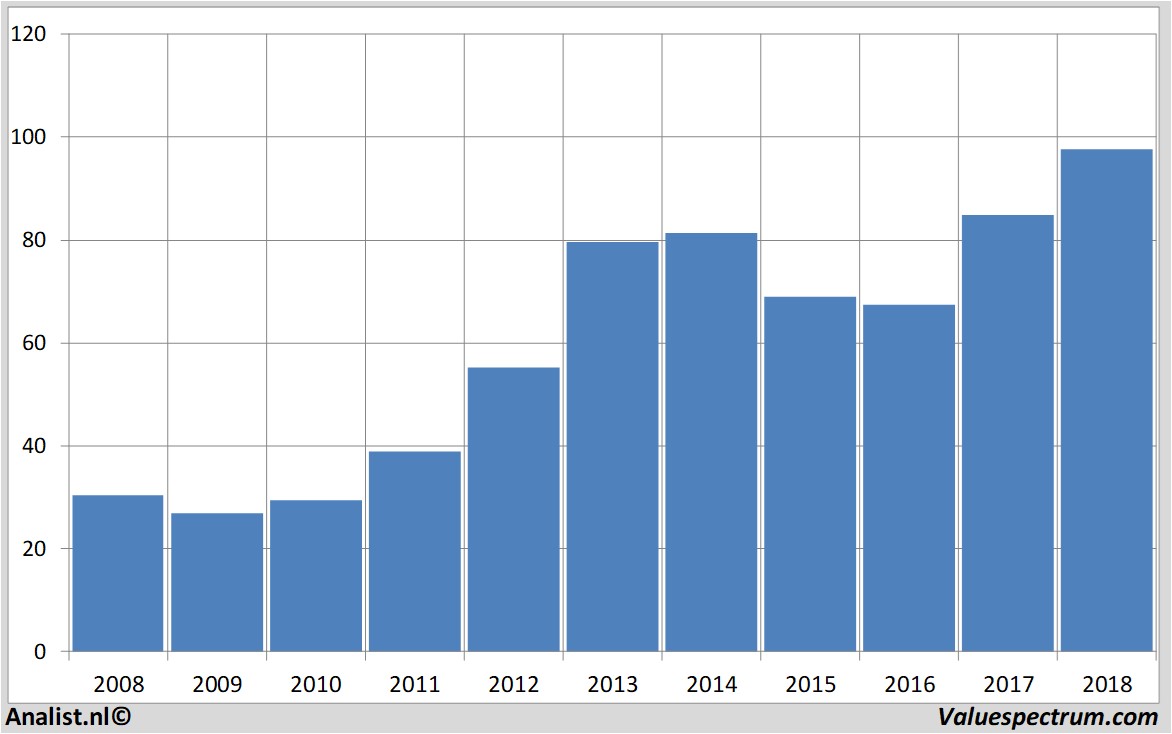

Historical revenues and results Eastman Chemical plus estimates 2018

The analysts expect for 2018 a net profit of 1,23 billion USD. According to most of the analysts the company will have a profit per share for this book year of 8,55 USD. The price/earnings-ratio is then 11,43.

Per share the analysts expect a dividend of 2,16 USD per share. Thus the dividend yield equals 2,21 percent. The average dividend yield of the chemical companies is a moderate 1 percent.

Eastman Chemical 's market capitalization is based on the number of outstanding shares around 14,31 billion USD. The Eastman Chemical stock was the past 12 months quite volatile. Since last August the stock is 18 percent higher. This year the stock price moved between 84 and 112 dollar. Since 2008 the stock price is almost 222 percent higher.

Historical stock prices Eastman Chemical

On Thursday the stock closed at 97,72 USD.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.