Huge positive momentum Heijmans

In the past years Heijmans was a very good choice for investors. The stock was the past 10 years with a return of 74 percent one of the larger outperformers of her peer group. The average stock of the sector yielded the past 10 years a gain of 184 percent. The average stock of the construction/infrastructure sector yielded the past 10 year a gain of 184 percent. Bauer , Astm and Mota Engil are other strong performing peers. Carillion , Graa Y Montero S.A.A. and Trakcja PRKiI PRKiI are some of the winning stocks in the sector.

Momentum construction/infrastructure sector

The sector trades now at 18 times the earnings per share. The sector trades at 4,4 times the book value per share. Since 2012 the sector made a plus of 205 percent and since 2007 a plus of 184 percent.

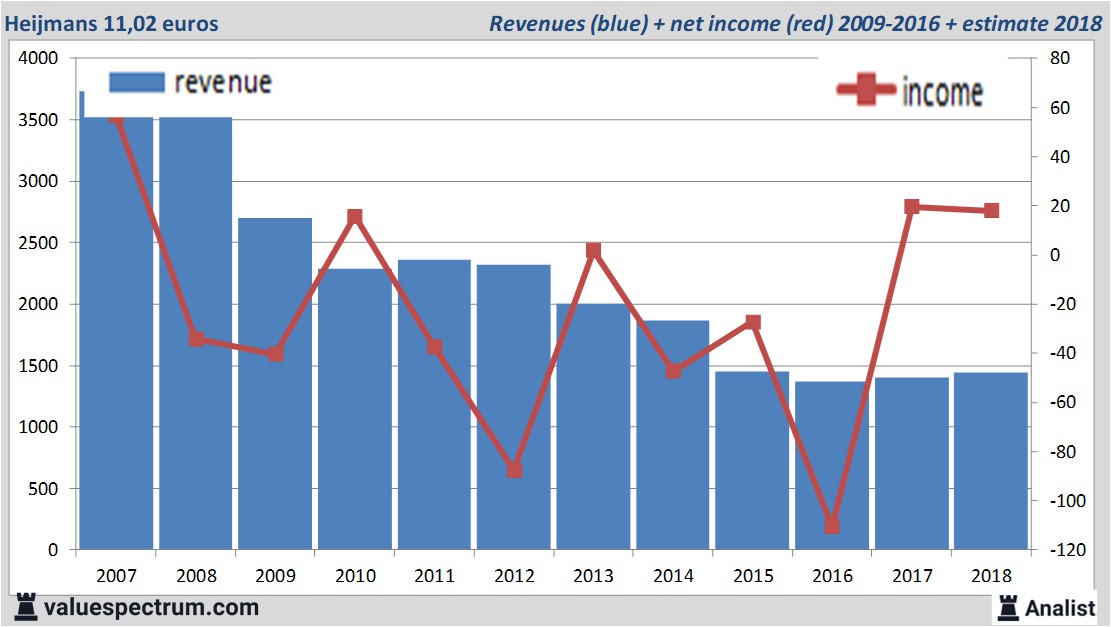

The sector trades now at 18 times the earnings per share. The sector trades at 4,4 times the book value per share. Since 2012 the sector made a plus of 205 percent and since 2007 a plus of 184 percent. For this year Heijmans 's revenue will be around 1,45 billion euros. This is according to the average of the analysts' estimates. This is slightly more than 2017's revenue of 1,4 billion euros.

Historical revenues and results Heijmans plus estimates 2018

The analysts expect for 2018 a net profit of 18 million euros. For this year the majority of the analysts, consulted by press agency Thomson Reuters, expects a profit per share of 91 cent. The PE-ratio therefore is 12,11.

Per share the analysts expect a dividend of 0,33 cents per share. The dividend yield is then 2,99 percent. The average dividend yield of the construction/infrastructure companies is a relatively high 2 percent.

Latest estimates around 13 euros

The most recent recommendations for the construction/infrastructure company are from Kepler Capital Markets, ING and NIBC. Heijmans 's market capitalization is based on the number of outstanding shares around 235,9 million euros.Historical stock prices Heijmans

At 11.29 the stock trades 0,36 percent higher at 11,02 euros.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.