Apple Inc. (NASDAQ: AAPL) Stock to Reach $210, Analyst Says

Apple . (NASDAQ: AAPL) is gaining ground after Loop Capital analyst Ananda Baruah increased his price target for the stock to $210 from $195. The analyst believes that Apple shares are “well-positioned” for the rest of 2018. Baruah thinks that Apple will gain value amid growth of its services business and the upcoming cheaper, LCD-based iPhone X. The new phone, according to the analyst, will give Apple a healthy mix of expensive and affordable phones to increase the revenue momentum.

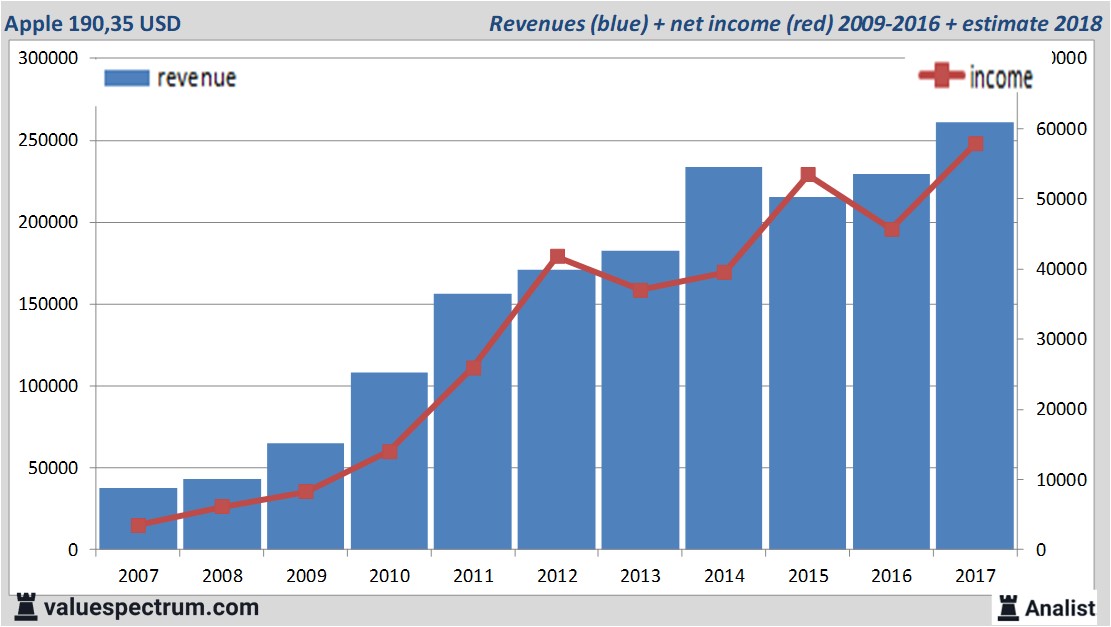

Over the current book year the total revenue will be 260,99 billion USD (consensus estimates). This is hugely more than 2017's revenue of 229,23 billion USD.

Historical revenues and results Apple plus estimates 2018

The analysts expect for 2018 a net profit of 57,8 billion USD. The majority of the analysts expects for this year a profit per share of 11,49 USD. So the price/earnings-ratio equals 16,57.

Per share the analysts expect a dividend of 2,71 USD per share. Thus the dividend yield equals 1,42 percent. The average dividend yield of the hardware & equipment companies equals a low 1 percent.

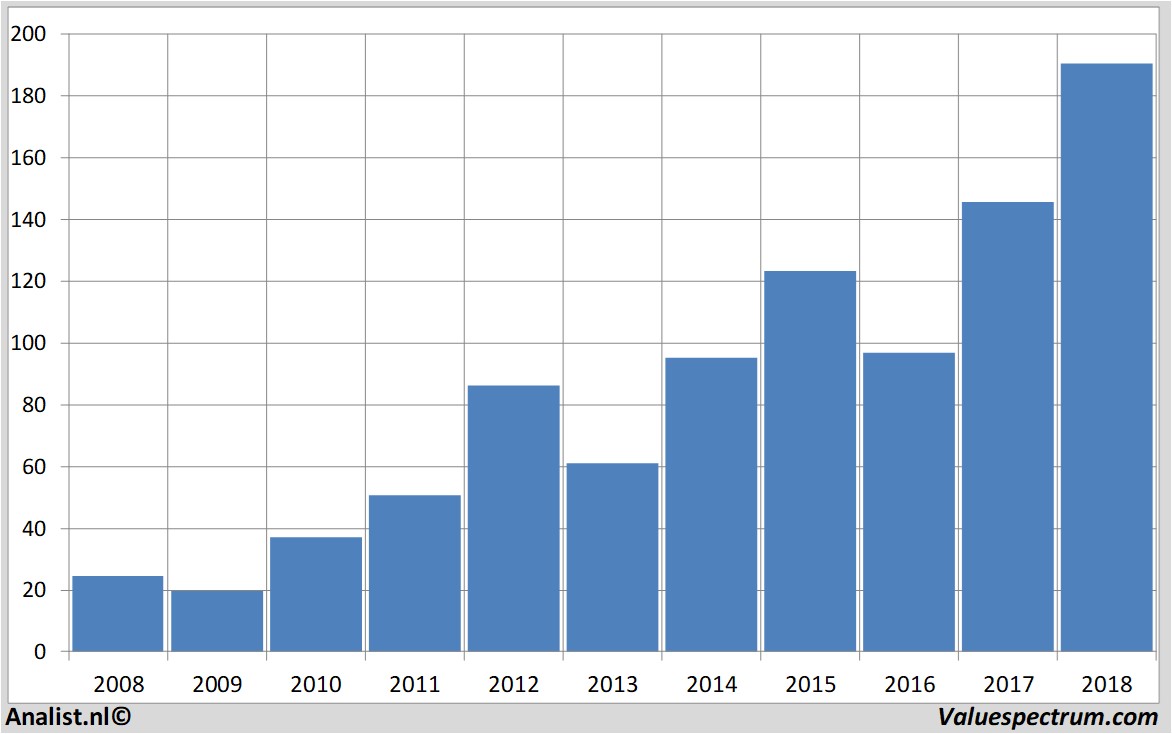

Latest estimates around 187 USD

The most recent recommendations for the hardware & equipment company are from RBC Capital Markets, Barclays and ABN AMRO. Apple 's market capitalization is based on the number of outstanding shares around 1015,74 billion USD. On Tuesday the stock closed at 190,35 USD.Price data Apple 2007-2018

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.