2016 super year, 2008 worst year for Kering

For years it were very profitable times for the shareholders of Kering . Also without dividend payments the stock belongs to the outperformers of both the personal goods sector as the French exchange. The received dividends increase the huge gains even further.

The matrix above shows Kering 's historical returns expressed in the different entry years in the left axis.

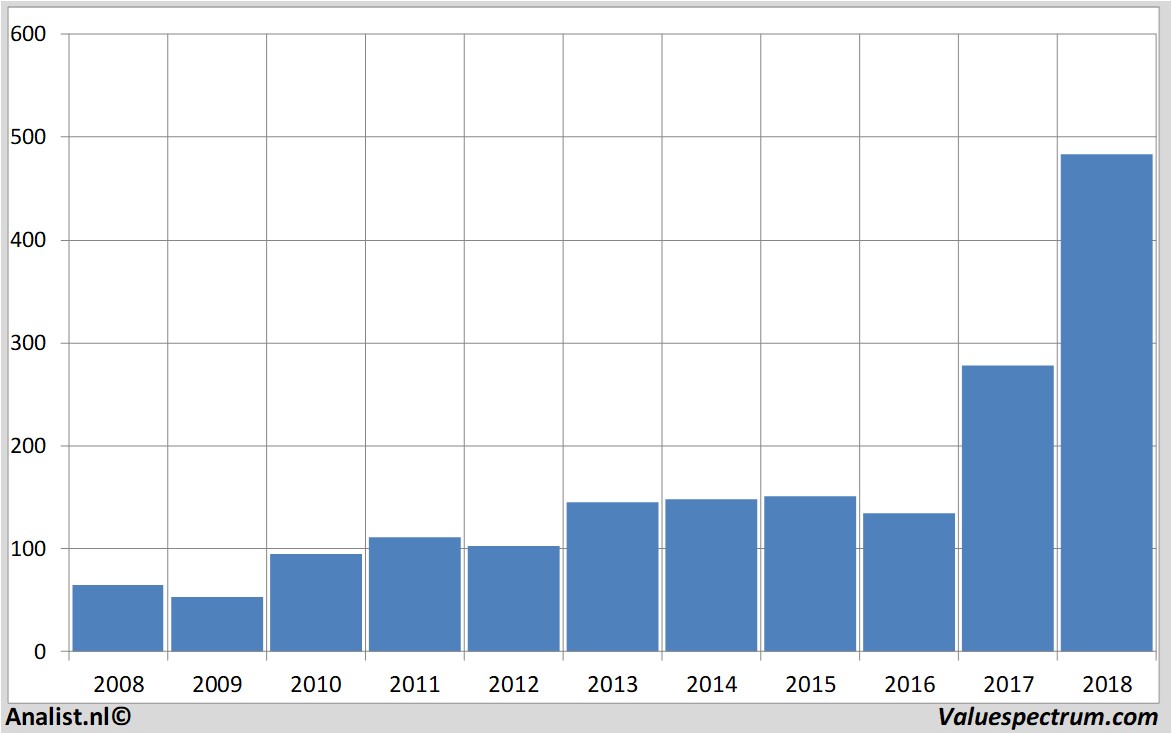

The year 2008 is (measured since 2008) with a price loss of 58 percent the stock's worst year. The stock touched new highs in 2017, gaining 84 percent in value. Who bought the stock in 2008 (price at that time 100,52 euros) now even has a price gain of 1036 percent.For this year Kering 's revenue will be around 13,15 billion euros. This is according to the average of the analysts' estimates. This is rather significant lower than 2017's revenue of 15,48 billion euros.

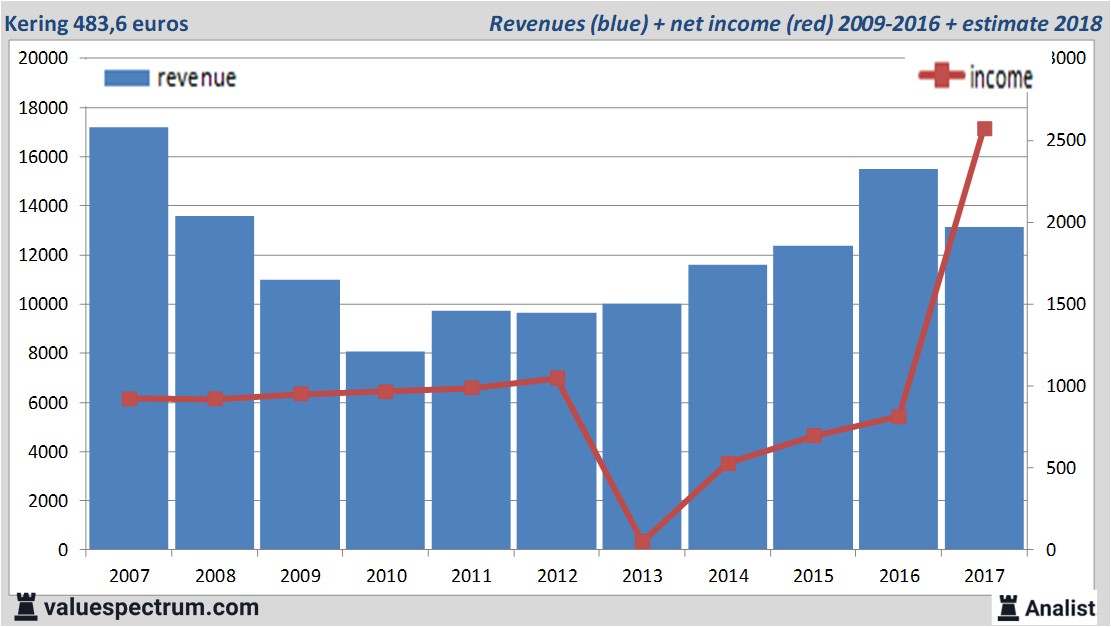

Historical revenues and results Kering plus estimates 2018

The analysts expect for 2018 a net profit of 2,57 billion euros. The majority of the analysts expects for this year a profit per share of 20,36 euros. The price/earnings-ratio therefore equals 23,75.

For this year most of the analysts expect a dividend of 7,32 euros per share. The dividend yield is then 1,51 percent. The average dividend yield of the personal goods companies is a limited 1 percent.

Newest target prices around 533 euros

Deutsche Bank, HSBC and JP Morgan recently provided recommendations for the stock. Kering 's market capitalization is based on the number of outstanding shares around 61,07 billion euros.Historical stock prices Kering past 10 years

At 17.35 the stock trades 1,47 percent higher at 483,6 euros.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.