Citi analysts see lower AB Inbev costs, upgrade to buy

Recently, AB AB InBev has experienced some positive developments. Citi upgraded the beer giant's stock from 'neutral" to 'buy," anticipating that AB AB InBev 's cost-management efforts and pricing strategies will improve margins, even with declining Bud Light sales in the U.S. market following the controversy surrounding the brand earlier this year. Despite ongoing sales challenges in the U.S. and weak demand in some regions like Mexico and China, AB AB InBev 's strong performance in other markets, particularly Brazil, is helping bolster its financial outlook. Brazilian sales volumes are forecast to grow in Q3, benefiting from price increases and cost controls that are also supporting the company's performance in South America.

Analysts expect AB AB InBev to release its Q3 results on October 31, 2024, with earnings projected to exceed its annual growth target of 4-8 percent; in EBITDA. Additionally, the company aims to reduce its net debt/EBITDA ratio below 3x by the end of 2024, potentially enabling a $1 billion stock buyback-a move that could strengthen investor confidence and support share prices. The upgraded price target of €69 also reflects a positive long-term view of AB AB InBev 's ability to stabilize its margins and improve EBITDA as commodity costs settle.

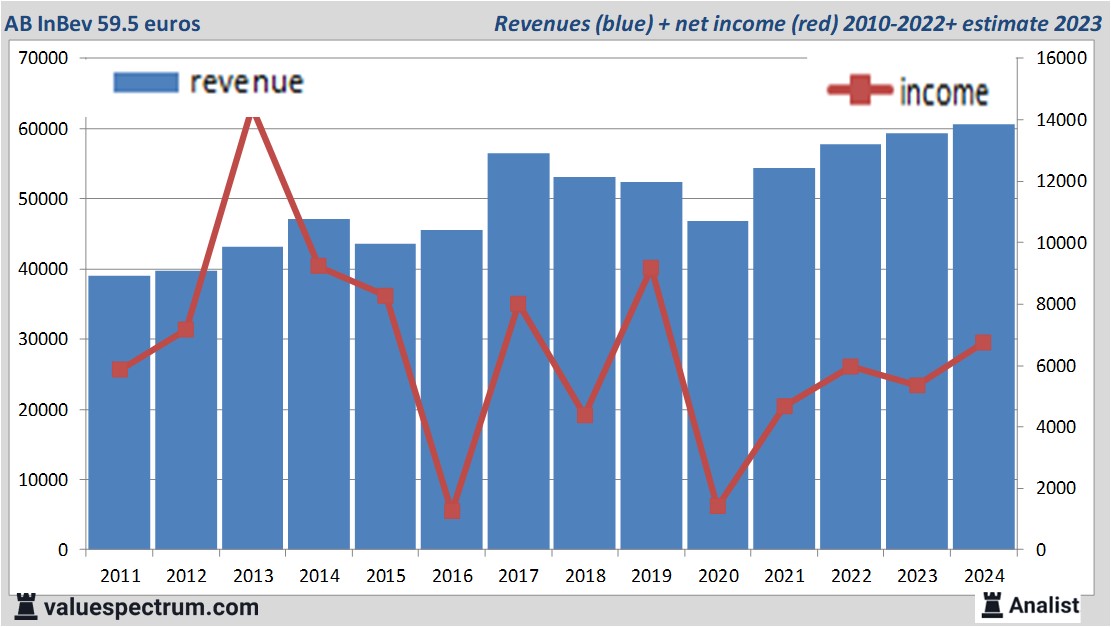

Tomorrow the Belgian AB AB InBev will report its past quarters results. For this year the company, located in Leuven (Louvain) revenue will be around 60.66 billion euros. This is according to the average of the analysts' estimates. The expected revenue would be a record for the company. This is slightly more than 2023's revenue of 59.38 billion euros.

Historical revenues and results AB AB InBev plus estimates 2023

AB AB InBev ©  AB AB InBev |

The analysts expect for 2024 a net profit of 6.75 billion euros. For this year the consensus of the result per share is a profit of 3.36 euros. The price/earnings-ratio is then 17.71.

Per share the analysts expect a dividend of 1.01 euros per share. AB AB InBev 's dividend yield thus equals 1.7 percent. The average dividend yield of the brewers equals an attractive 1.91 percent.

Recent target prices around 73 euros

The latest 3 recommendations for the brewer were provided by KBC Securities, Sanford C. Bernstein & Co and Citigroup .AB AB InBev 's market capitalization is based on the number of outstanding shares around 101.25 billion euros.

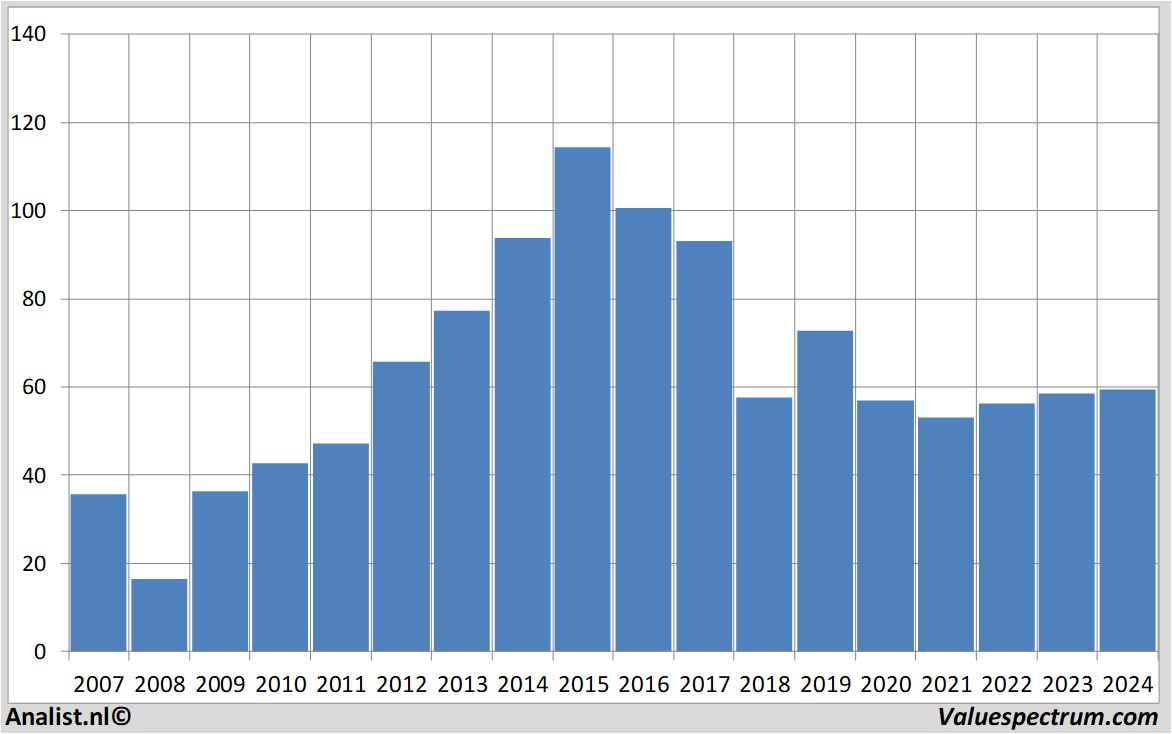

Historical stock prices AB AB InBev

On Tuesday the stock closed at 59.5 euros.

Analist.nl Nieuwsdienst: +31 084-0032-842

nieuws@analist.nl

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. Analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.